Nokia 2008 Annual Report Download - page 162

Download and view the complete annual report

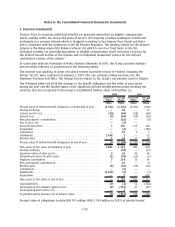

Please find page 162 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

Income taxes

Current taxes are based on the results of the Group companies and are calculated according to local

tax rules.

Deferred tax assets and liabilities are determined, using the liability method, for all temporary

differences arising between the tax bases of assets and liabilities and their carrying amounts in the

consolidated financial statements. Deferred tax assets are recognized to the extent that it is probable

that future taxable profit will be available against which the unused tax losses or deductible

temporary differences can be utilized. Deferred tax liabilities are recognized for temporary differences

that arise between the fair value and tax base of identifiable net assets acquired in business

combinations.

The enacted or substantially enacted tax rates as of each balance sheet date that are expected to

apply in the period when the asset is realized or the liability is settled are used in the measurement

of deferred tax assets and liabilities.

Deferred taxes are recognized directly in equity, when temporary differences arise on items that are

not recognized in the profit and loss.

Provisions

Provisions are recognized when the Group has a present legal or constructive obligation as a result of

past events, it is probable that an outflow of resources will be required to settle the obligation and a

reliable estimate of the amount can be made. Where the Group expects a provision to be reimbursed,

the reimbursement is recognized as an asset only when the reimbursement is virtually certain. At

each balance sheet date, the Group assesses the adequacy of its preexisting provisions and adjusts

the amounts as necessary based on actual experience and changes in future estimates.

Warranty provisions

The Group provides for the estimated liability to repair or replace products under warranty at the

time revenue is recognized. The provision is an estimate calculated based on historical experience of

the level of repairs and replacements.

Intellectual property rights (IPR) provisions

The Group provides for the estimated future settlements related to asserted and unasserted IPR

infringements based on the probable outcome of potential infringement.

Tax provisions

The Group recognizes a provision for tax contingencies based upon the estimated future settlement

amount at each balance sheet date.

Restructuring provisions

The Group provides for the estimated cost to restructure when a detailed formal plan of restructuring

has been completed and the restructuring plan has been announced.

Other provisions

The Group recognizes the estimated liability for noncancellable purchase commitments for inventory

in excess of forecasted requirements at each balance sheet date.

F18

Notes to the Consolidated Financial Statements (Continued)