Nokia 2008 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227

|

|

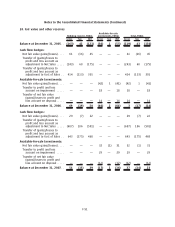

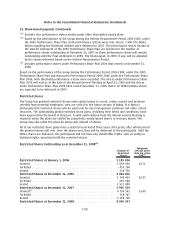

22. Sharebased payment (Continued)

The table below sets forth certain information relating to the stock options outstanding at

December 31, 2008.

Plan

(year of launch)

Stock options

outstanding

2008

Number of

participants

(approx.)

Option (sub)

category

Vesting status

(as percentage of

total number of

stock options

outstanding) First vest date Last vest date Expiry date

Exercise price/

share

EUR

Exercise period

2003

(1)

3 217 206 3 000 2003 2Q Expired July 1, 2004 July 2, 2007 December 31, 2008 14.95

2003 3Q Expired October 1, 2004 October 1, 2007 December 31, 2008 12.71

2003 4Q Expired January 3, 2005 January 2, 2008 December 31, 2008 15.05

2004 2Q 100.00 July 1, 2005 July 1, 2008 December 31, 2009 11.79

2004 3Q 100.00 October 3, 2005 October 1, 2008 December 31, 2009 9.44

2004 4Q 93.75 January 2, 2006 January 2, 2009 December 31, 2009 12.35

2005

(1)

13 277 078 8 000 2005 2Q 81.25 July 1, 2006 July 1, 2009 December 31, 2010 12.79

2005 3Q 75.00 October 1, 2006 October 1, 2009 December 31, 2010 13.09

2005 4Q 68.75 January 1, 2007 January 1, 2010 December 31, 2010 14.48

2006 1Q 62.50 April 1, 2007 April 1, 2010 December 31, 2011 14.99

2006 2Q 56.25 July 1, 2007 July 1, 2010 December 31, 2011 18.02

2006 3Q 50.00 October 1, 2007 October 1, 2010 December 31, 2011 15.37

2006 4Q 43.75 January 1, 2008 January 1, 2011 December 31, 2011 15.38

2007 1Q 37.50 April 1, 2008 April 1, 2011 December 31, 2011 17.00

2007

(1)

6 618 934 6 000 2007 2Q 31.25 July 1, 2008 July 1, 2011 December 31, 2012 18.39

2007 3Q 25.00 October 1, 2008 October 1, 2011 December 31, 2012 21.86

2007 4Q — January 1, 2009 January 1, 2012 December 31, 2012 27.53

2008 1Q — April 1, 2009 April 1, 2012 December 31, 2013 24.15

2008 2Q — July 1, 2009 July 1, 2012 December 31, 2013 19.16

2008 3Q — October 1, 2009 October 1, 2012 December 31, 2013 17.80

2008 4Q — January 1, 2010 January 1, 2013 December 31, 2013 12.43

(1)

The Group’s current global stock option plans have a vesting schedule with a 25% vesting one

year after grant, and quarterly vesting thereafter, each of the quarterly lots representing 6.25% of

the total grant. The grants vest fully in four years.

F55

Notes to the Consolidated Financial Statements (Continued)