Nokia 2008 Annual Report Download - page 87

Download and view the complete annual report

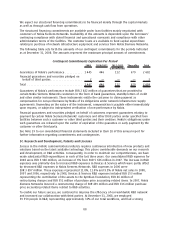

Please find page 87 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interests, was negative 14%, negative 62% and negative 69% at December 31, 2008, 2007 and 2006,

respectively.

Our Board of Directors has proposed a dividend of EUR 0.40 per share for the year ended

December 31, 2008, subject to shareholders’ approval, compared with EUR 0.53 and EUR 0.43 per

share paid for the years ended December 31, 2007 and 2006, respectively. See Item 3.A “Selected

Financial Data—Distribution of Earnings.”

Our refinancing needs in 2009 will include refinancing of our shortterm borrowings incurred in

connection with the NAVTEQ acquisition and refinancing of Nokia Siemens Networks’ bilateral loan

arrangements with financial institutions. We also may incur additional indebtedness from time to

time as required to finance acquisitions and working capital needs. In February 2009, we issued

EUR 1 750 million of Eurobonds—EUR 1 250 million bonds due 2014 with a coupon of 5.50% and

issue price of 99.855%; and EUR 500 million bonds due 2019 with a coupon of 6.75% and issue price

of 99.702%—under our EUR 3 000 million Euro Medium Term Note, or EMTN, program to repay part of

our existing shortterm borrowings. In February 2009, we also signed and fully drew down

EUR 500 million loan from the European Investment Bank. The proceeds of the loan will be used to

finance part of our smartphone research and development expenses.

At December 31, 2008, Nokia had a USD 4 000 million US Commercial Paper, or USCP, program,

USD 4 000 million Euro Commercial Paper, or ECP, program, EUR 3 000 million EMTN program,

domestic Finnish commercial paper program totaling EUR 750 million and shelf registration statement

for an indeterminate amount of debt securities on file with the US Securities and Exchange

Commission. At December 31, 2008, we also had committed credit facilities of USD 2 000 million

maturing in 2009, EUR 500 million maturing in 2011, USD 1 923 million maturing in 2012, and a

number of shortterm uncommitted facilities. In February 2009, we voluntarily cancelled the USD 2

000 million committed credit facility maturing in 2009 due to the abovedescribed repayment of part

of our shortterm borrowings from the proceeds of the Eurobond issue in February 2009. At

February 28, 2009, the total amount available to us under our committed credit facilities was

EUR 404 million, excluding the amounts available only for the repayment of our outstanding

commercial papers. See Note 35 (c) to our consolidated financial statements included in Item 18 of

this annual report for further information relating to our funding programs.

We have historically maintained a high level of liquid assets. Management estimates that the cash

and other liquid assets level of EUR 6 820 million at the end of 2008, together with our available

credit facilities, cash flow from operations, funds available from longterm and shortterm debt

financings, as well as the proceeds of future equity or convertible bond offerings, will be sufficient to

satisfy our future working capital needs, capital expenditure, research and development, acquisitions

and debt service requirements at least through 2009. The ratings of our short and longterm debt

from credit rating agencies have not changed during the year. The ratings at December 31, 2008,

were:

Shortterm Standard & Poor’s A1

Moody’s P1

Longterm Standard & Poor’s A

Moody’s A1

We believe that Nokia will continue to be able to access the capital markets on terms and in amounts

that will be satisfactory to us, and that we will be able to obtain bid and performance bonds, to

arrange or provide customer financing as necessary to support our business and to engage in

hedging transactions on commercially acceptable terms.

We primarily invest in research and development, marketing and building the Nokia brand. However,

over the past few years Nokia has increased its investment in services and software by acquiring

companies with specific technology assets and expertise. In 2008, capital expenditures totaled

EUR 889 million, compared with EUR 715 million in 2007 and EUR 650 million in 2006. The increase in

2008 resulted from increased amount of capital expenditures in machinery and equipment and

86