Nokia 2008 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

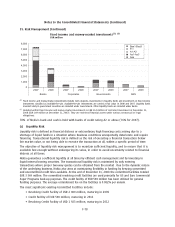

35. Risk Management (Continued)

on creating shareholder value. Treasury activities support this aim by: i) minimizing the adverse

effects caused by fluctuations in the financial markets on the profitability of the underlying

businesses; and ii) managing the capital structure of the Group by prudently balancing the levels of

liquid assets and financial borrowings.

Treasury activities are governed by policies approved by the CEO. Treasury Policy provides principles

for overall financial risk management and determines the allocation of responsibilities for financial

risk management in Nokia. Operating Procedures cover specific areas such as foreign exchange risk,

interest rate risk, use of derivative financial instruments, as well as liquidity and credit risk. Nokia is

risk averse in its Treasury activities.

(a) Market Risk

Foreign exchange risk

Nokia operates globally and is thus exposed to foreign exchange risk arising from various currencies.

Foreign currency denominated assets and liabilities together with expected cash flows from highly

probable purchases and sales contribute to foreign exchange exposure. These transaction exposures

are managed against various local currencies because of Nokia’s substantial production and sales

outside the Eurozone.

According to the foreign exchange policy guidelines of the Group, which remain the same as in the

previous year, material transaction foreign exchange exposures are hedged. Exposures are mainly

hedged with derivative financial instruments such as forward foreign exchange contracts and foreign

exchange options. The majority of financial instruments hedging foreign exchange risk have duration of

less than a year. The Group does not hedge forecasted foreign currency cash flows beyond two years.

Since Nokia has subsidiaries outside the Euro zone, the eurodenominated value of the shareholders’

equity of Nokia is also exposed to fluctuations in exchange rates. Equity changes resulting from

movements in foreign exchange rates are shown as a translation difference in the Group consolidation.

Nokia uses, from time to time, foreign exchange contracts and foreign currency denominated loans to

hedge its equity exposure arising from foreign net investments.

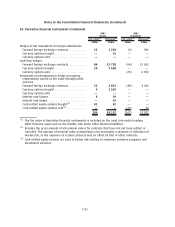

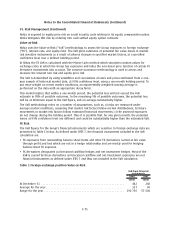

At the end of year 2008 and 2007, following currencies represent significant portion of the currency

mix in the outstanding financial instruments:

2008 USD JPY CNY INR

EURm EURm EURm EURm

FX derivatives used as cashflow hedges (net amount)

(1)

........... (3359) 2674 — (122)

FX derivatives used as net investment hedges (net amount)

(2)

...... (232) — (699) (179)

FX exposure from balance sheet items (net amount)

(3)

............ 729 (494) (579) 236

FX derivatives not designated in a hedge relationship and carried at

fair value through the profit and loss statement (net amount)

(3)

. . (615) 480 527 (443)

2007 USD JPY GBP INR

4

EURm EURm EURm EURm

FX derivatives used as cashflow hedges (net amount)

(1)

........... 803 1274 (656) (83)

FX derivatives used as net investment hedges (net amount)

(2)

...... — — — (216)

FX exposure from balance sheet items (net amount)

(3)

............ 2204 (739) 89 320

FX derivatives not designated in a hedge relationship and carried at

fair value through the profit and loss statement (net amount)

(3)

. . (2 361) 847 (127) (399)

F73

Notes to the Consolidated Financial Statements (Continued)