Nokia 2008 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. Other operating income and expenses (Continued)

recorded restructuring costs of EUR 35 million primarily related to restructuring of a subsidiary

company.

Other operating income for 2006 includes a gain of EUR 276 million representing Nokia’s share of the

proceeds relating to a partial recovery of a previously impaired financing arrangement with Telsim.

Other operating expenses for 2006 includes EUR 142 million charges primarily related to the

restructuring for the CDMA business and associated asset writedowns. Working together with co

development partners, Nokia intended to selectively participate in key CDMA markets, with special

focus on North America, China and India. Accordingly, Nokia ramped down its CDMA research,

development and production which ceased by April 2007. In 2006, Devices & Services recorded a

charge of EUR 8 million for personnel expenses and other costs as a result of more focused R&D.

In all three years presented “Other operating income and expenses” include the costs of hedging

forecasted sales and purchases (forward points of cash flow hedges).

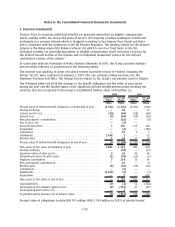

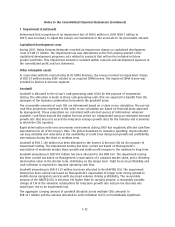

7. Impairment

2008 2007 2006

EURm EURm EURm

Property, plant and equipment ........................................ 77 ——

Inventories ........................................................ 13 ——

Availableforsale investments......................................... 43 29 18

Investments in associated companies................................... 87—

Capitalized development costs ........................................ —27 —

Other intangible assets .............................................. — — 33

Other noncurrent assets ............................................. 8——

Total, net ......................................................... 149 63 51

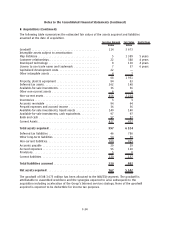

Property, plant and equipment and inventories

In conjunction with the Group’s decision to discontinue the production of mobile devices in Germany,

an impairment loss was recognized amounting to EUR 55 million. The impairment loss related to the

closure and sale of production facilities at Bochum, Germany during 2008 and was included in Devices

& Services segment.

In 2008, Nokia Siemens Networks recognized an impairment loss amounting to EUR 35 million

relating to the sale of its manufacturing site in Durach, Germany. The impairment loss was

determined as the excess of the book value of transferring assets over the fair value less costs to sell

for the transferring assets. The impairment loss was allocated to property, plant and equipment and

inventories.

Availableforsale investments

The Group’s investment in certain equity securities held as noncurrent availableforsale suffered a

permanent decline in fair value resulting in an impairment charge of EUR 43 million (EUR 29 million

in 2007, EUR 18 million in 2006).

Investments in associated companies

After application of the equity method, including recognition of the associate’s losses, the Group

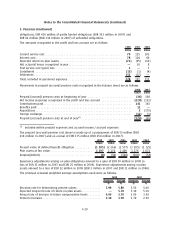

F31

Notes to the Consolidated Financial Statements (Continued)