Nokia 2008 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

The ultimate outcome or actual cost of settling an individual infringement may materially vary from

estimates.

Legal contingencies

Legal proceedings covering a wide range of matters are pending or threatened in various jurisdictions

against the Group. Provisions are recorded for pending litigation when it is determined that an

unfavorable outcome is probable and the amount of loss can be reasonably estimated. Due to the

inherent uncertain nature of litigation, the ultimate outcome or actual cost of settlement may

materially vary from estimates.

Capitalized development costs

The Group capitalizes certain development costs when it is probable that a development project will

generate future economic benefits and certain criteria, including commercial and technological

feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle,

material development costs may be required to be writtenoff in future periods.

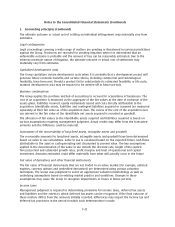

Business combinations

The Group applies the purchase method of accounting to account for acquisitions of businesses. The

cost of an acquisition is measured as the aggregate of the fair values at the date of exchange of the

assets given, liabilities incurred, equity instruments issued and costs directly attributable to the

acquisition. Identifiable assets, liabilities and contingent liabilities acquired or assumed are measured

separately at their fair value as of the acquisition date. The excess of the cost of the acquisition over

our interest in the fair value of the identifiable net assets acquired is recorded as goodwill.

The allocation of fair values to the identifiable assets acquired and liabilities assumed is based on

various assumptions requiring management judgment. Actual results may differ from the forecasted

amounts and the difference could be material.

Assessment of the recoverability of longlived assets, intangible assets and goodwill

The recoverable amounts for longlived assets, intangible assets and goodwill have been determined

based on value in use calculations. Value in use is calculated based on the expected future cash flows

attributable to the asset or cashgenerating unit discounted to present value. The key assumptions

applied in the determination of the value in use include the discount rate, length of the explicit

forecast period and estimated growth rates, profit margins and level of operational and capital

investment. Amounts estimated could differ materially from what will actually occur in the future.

Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example, unlisted

equities, currency options and embedded derivatives) are determined using various valuation

techniques. The Group uses judgment to select an appropriate valuation methodology as well as

underlying assumptions based on existing market practice and conditions. Changes in these

assumptions may cause the Group to recognize impairments or losses in future periods.

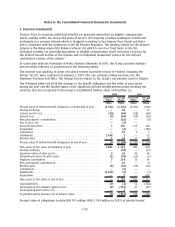

Income taxes

Management judgment is required in determining provisions for income taxes, deferred tax assets

and liabilities and the extent to which deferred tax assets can be recognized. If the final outcome of

these matters differs from the amounts initially recorded, differences may impact the income tax and

deferred tax provisions in the period in which such determination is made.

F21

Notes to the Consolidated Financial Statements (Continued)