Nokia 2008 Annual Report Download - page 176

Download and view the complete annual report

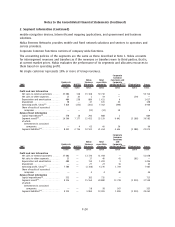

Please find page 176 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Impairment (Continued)

determined that recognition of an impairment loss of EUR 8 million in 2008 (EUR 7 million in

2007) was necessary to adjust the Group’s net investment in the associate to its recoverable amount.

Capitalized development costs

During 2007, Nokia Siemens Networks recorded an impairment charge on capitalized development

costs of EUR 27 million. The impairment loss was determined as the full carrying amount of the

capitalized development programs costs related to products that will not be included in future

product portfolios. This impairment amount is included within research and development expenses in

the consolidated profit and loss statement.

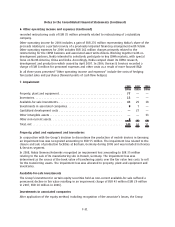

Other intangible assets

In connection with the restructuring of its CDMA business, the Group recorded an impairment charge

of EUR 33 million during 2006 related to an acquired CDMA license. The impaired CDMA license was

included in Devices & Services segment.

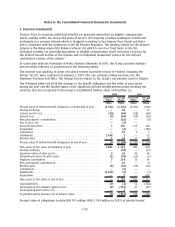

Goodwill

Goodwill is allocated to the Group’s cashgenerating units (CGU) for the purpose of impairment

testing. The allocation is made to those cashgenerating units that are expected to benefit from the

synergies of the business combination from which the goodwill arose.

The recoverable amounts of each CGU are determined based on a value in use calculation. The pretax

cash flow projections employed in the value in use calculation are based on financial plans approved

by management. These projections are consistent with external sources of information, wherever

available. Cash flows beyond the explicit forecast period are extrapolated using an estimated terminal

growth rate that does not exceed the longterm average growth rates for the industry and economies

in which the CGU operates.

Rapid deterioration in the macroeconomic environment during 2008 has negatively affected cash flow

expectations for all of the Group’s CGUs. The global slowdown in consumer spending, unprecedented

currency volatility and reductions in the availability of credit have dampened growth and profitability

expectations during the short to medium term.

Goodwill of EUR 1 106 million has been allocated to the Devices & Services CGU for the purpose of

impairment testing. The impairment testing has been carried out based on Management’s

expectation of moderate market share growth and stable profit margins in the medium to long term.

Goodwill amounting to EUR 905 million has been allocated to the NSN CGU. The impairment testing

has been carried out based on Management’s expectation of a constant market share, and a declining

total market value in the shorter term, stabilizing on the longer term. Tight focus on profitability and

cash collection is expected to improve operating cash flow.

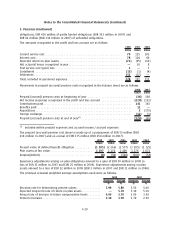

Goodwill amounting to EUR 4 119 million has been allocated to the NAVTEQ CGU. The impairment

testing has been carried out based on Management’s expectation of longer term strong growth in

mobile device navigation services with increased volumes driving profitability. The recoverable

amount of the NAVTEQ CGU is less than 1% higher than its carrying amount. A reasonably possible

change of 1% in the valuation assumptions for longterm growth rate and pretax discount rate

would give rise to an impairment loss.

The aggregate carrying amount of goodwill allocated across multiple CGUs amounts to

EUR 127 million and the amount allocated to each individual CGU is not individually significant.

F32

Notes to the Consolidated Financial Statements (Continued)