Nokia 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1. Accounting principles (Continued)

The Group provides for onerous contracts based on the lower of the expected cost of fulfilling the

contract and the expected cost of terminating the contract.

Sharebased compensation

The Group offers three types of equity settled sharebased compensation schemes for employees:

stock options, performance shares and restricted shares. Employee services received, and the

corresponding increase in equity, are measured by reference to the fair value of the equity

instruments as of the date of grant, excluding the impact of any nonmarket vesting conditions. Non

market vesting conditions attached to the performance shares are included in assumptions about the

number of shares that the employee will ultimately receive. On a regular basis, the Group reviews the

assumptions made and, where necessary, revises its estimates of the number of performance shares

that are expected to be settled. Sharebased compensation is recognized as an expense in the profit

and loss account over the service period. A separate vesting period is defined for each quarterly lot of

the stock options plans. When stock options are exercised, the proceeds received net of any

transaction costs are credited to share premium and the reserve for invested nonrestricted equity.

Treasury shares

The Group recognizes acquired treasury shares as a deduction from equity at their acquisition cost.

When cancelled, the acquisition cost of treasury shares is recognized in retained earnings.

Dividends

Dividends proposed by the Board of Directors are not recorded in the financial statements until they

have been approved by the shareholders at the Annual General Meeting.

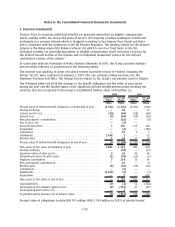

Earnings per share

The Group calculates both basic and diluted earnings per share. Basic earnings per share is computed

using the weighted average number of shares outstanding during the period. Diluted earnings per

share is computed using the weighted average number of shares outstanding during the period plus

the dilutive effect of stock options, restricted shares and performance shares outstanding during the

period.

Use of estimates

The preparation of financial statements in conformity with IFRS requires the application of judgment

by management in selecting appropriate assumptions for calculating financial estimates, which

inherently contain some degree of uncertainty. Management bases its estimates on historical

experience and various other assumptions that are believed to be reasonable under the

circumstances, the results of which form the basis for making judgments about the reported carrying

values of assets and liabilities and the reported amounts of revenues and expenses that may not be

readily apparent from other sources. Actual results may differ from these estimates under different

assumptions or conditions.

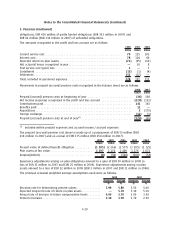

Set forth below are areas requiring significant judgment and estimation that may have an impact on

reported results and the financial position.

Revenue recognition

Sales from the majority of the Group are recognized when the significant risks and rewards of

ownership have transferred to the buyer, continuing managerial involvement usually associated with

ownership and effective control have ceased, the amount of revenue can be measured reliably, it is

F19

Notes to the Consolidated Financial Statements (Continued)