Nokia 2008 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

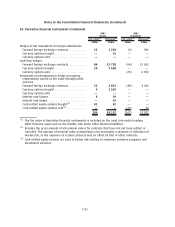

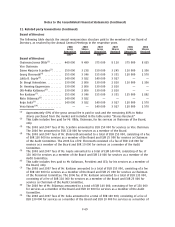

32. Notes to cash flow statement

2008 2007 2006

EURm EURm EURm

Adjustments for:

Depreciation and amortization (Note 9) ............................ 1 617 1 206 712

(Profit)/loss on sale of property, plant and equipment and

availableforsale investments .................................. (11) (1 864) (4)

Income taxes (Note 11) ......................................... 1 081 1 522 1 357

Share of results of associated companies (Note 14) . .................. (6) (44) (28)

Minority interest .............................................. (99) (459) 60

Financial income and expenses (Note 10)........................... 2(239) (207)

Impairment charges (Note 7) .................................... 149 63 51

Retirements (Note 8, 12) ........................................ 186 ——

Sharebased compensation (Note 22) .............................. 74 228 192

Restructuring charges .......................................... 448 856 —

Customer financing impairment charges and reversals ................ —— (276)

Finnish pension settlement (Note 5) ............................... 152 ——

Other income and expenses ..................................... (124) ——

Adjustments, total ............................................. 3 469 1 269 1 857

Change in net working capital (Increase) in shortterm receivables ...... (534) (2 146) (1 770)

Decrease (Increase) in inventories ............................... 321 (245) 84

(Decrease) Increase in interestfree shortterm liabilities ............. (2 333) 2 996 893

Change in net working capital ................................... (2 546) 605 (793)

The Group did not engage in any material noncash investing activities in 2008 and 2006. In 2007 the

formation of Nokia Siemens Networks was completed through the contribution of certain tangible

and intangible assets and certain business interests that comprised Nokia’s networks business and

Siemens’ carrierrelated operations. See Note 8.

33. Subsequent events

Eurobond issuance under Euro Medium Term Note program and European Investment Bank loan

In February 2009, the Group issued EUR 1 750 million of Eurobonds with maturities of five and ten

years under its EUR 3 000 million Euro Medium Term Note, or EMTN program, to repay part of the

Group’s existing shortterm borrowings. The Group voluntarily cancelled its USD 2 000 million

committed credit facility maturing in 2009 due to this repayment. In February, the Group also signed

and fully drew down a EUR 500 million loan from the European Investment Bank to finance part of its

smartphone research and development expenses.

F71

Notes to the Consolidated Financial Statements (Continued)