Nokia 2008 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

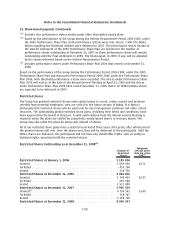

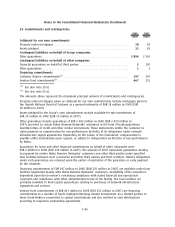

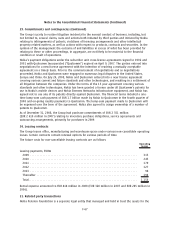

29. Commitments and contingencies

2008 2007

EURm EURm

Collateral for our own commitments

Property under mortgages ................................................ 18 18

Assets pledged ......................................................... 11 29

Contingent liabilities on behalf of Group companies

Other guarantees . . ..................................................... 2 896 2 563

Contingent liabilities on behalf of other companies

Financial guarantees on behalf of third parties ............................... 2130

Other guarantees . . ..................................................... 11

Financing commitments

Customer finance commitments

(1)

.......................................... 197 270

Venture fund commitments

(2)

............................................. 467 251

(1)

See also note 35 b).

(2)

See also note 35 a).

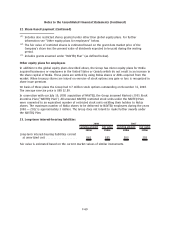

The amounts above represent the maximum principal amount of commitments and contingencies.

Property under mortgages given as collateral for our own commitments include mortgages given to

the Finnish National Board of Customs as a general indemnity of EUR 18 million in 2008 (EUR

18 million in 2007).

Assets pledged for the Group’s own commitments include availableforsale investments of

EUR 10 million in 2008 (EUR 10 million in 2007).

Other guarantees include guarantees of EUR 2 682 million in 2008 (EUR 2 429 million in

2007) provided to certain Nokia Siemens Networks’ customers in the form of bank guarantees,

standby letters of credit and other similar instruments. These instruments entitle the customer to

claim payment as compensation for nonperformance by Nokia of its obligations under network

infrastructure supply agreements. Depending on the nature of the instrument, compensation is

payable either immediately upon request, or subject to independent verification of nonperformance

by Nokia.

Guarantees for loans and other financial commitments on behalf of other companies were

EUR 2 million in 2008 (EUR 130 million in 2007). The amount of 2007 represents guarantees relating

to payment by certain Nokia Siemens Networks’ customers and other third parties under specified

loan facilities between such a customer and other third parties and their creditors. Nokia’s obligations

under such guarantees are released upon the earlier of expiration of the guarantee or early payment

by the customer.

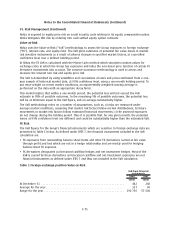

Financing commitments of EUR 197 million in 2008 (EUR 270 million in 2007) are available under loan

facilities negotiated mainly with Nokia Siemens Networks’ customers. Availability of the amounts is

dependent upon the borrower’s continuing compliance with stated financial and operational

covenants and compliance with other administrative terms of the facility. The loan facilities are

primarily available to fund capital expenditure relating to purchases of network infrastructure

equipment and services.

Venture fund commitments of EUR 467 million in 2008 (EUR 251 million in 2007) are financing

commitments to a number of funds making technology related investments. As a limited partner in

these funds Nokia is committed to capital contributions and also entitled to cash distributions

according to respective partnership agreements.

F66

Notes to the Consolidated Financial Statements (Continued)