Nokia 2008 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35. Risk Management (Continued)

(1)

The FX derivatives are used to hedge the foreign exchange risk from forecasted highly probably

cashflows related to sales, purchases and business acquisition activities. In some of the

currencies, especially in US Dollar, Nokia has substantial foreign exchange risks in both estimated

cash inflows and outflows, which have been netted in the table. See Note 20 for more details on

hedge accounting. The underlying exposures for which these hedges are entered into are not

presented in the table, as they are not financial instruments as defined under IFRS 7.

(2)

The FX derivatives are used to hedge the Group’s net investment exposure. The underlying

exposures for which these hedges are entered into are not presented in the table, as they are not

financial instruments as defined under IFRS 7.

(3)

The balance sheet items which are denominated in the foreign currencies are hedged by a portion

of FX derivatives not designated in a hedge relationship and carried at fair value through the profit

and loss statement, resulting in offsetting FX gains or losses in the financial income and expenses.

(4)

The INR amounts for 2007 have been revised as compared to previously published financial

statements due to a change in the way Nokia defines foreign exchange exposures.

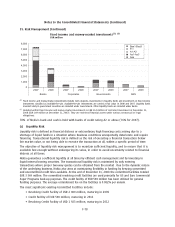

Interest rate risk

The Group is exposed to interest rate risk either through market value fluctuations of balance sheet

items (i.e. price risk) or through changes in interest income or expenses (i.e. reinvestment risk).

Interest rate risk mainly arises through interest bearing liabilities and assets. Estimated future

changes in cash flows and balance sheet structure also expose the Group to interest rate risk.

The objective of interest rate risk management is to optimize the balance between minimizing

uncertainty caused by fluctuations in interest rates and maximizing the consolidated net interest

income and expense.

The interest rate exposure of the Group is monitored and managed centrally. Nokia uses the Valueat

Risk (VAR) methodology to assess and measure the interest rate risk of the net investments (cash and

investments less outstanding debt) and related derivatives.

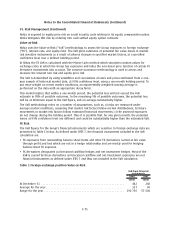

As at the reporting date, the interest rate profile of the Group’s interestbearing assets and liabilities

is presented in the table below:

2008 2007

EURm EURm

Fixed rate assets . ....................................................... 2946 7750

Floating rate assets ..................................................... 4007 4205

Fixed rate liabilities ..................................................... 3604 712

Floating rate liabilities ................................................... 785 375

Equity price risk

Nokia is exposed to equity price risk as the result of market price fluctuations in the listed equity

instruments held mainly for strategic business reasons.

Nokia has certain strategic minority investments in publicly listed equity shares. The fair value of the

equity investments which are subject to equity price risk at December 31, 2008 was EUR 8 million

(EUR 10 million in 2007). In addition, Nokia invests in private equity through venture funds, which,

from time to time, may have holdings in equity instruments which are listed in stock exchanges.

These investments are classified as availableforsale carried at fair value. See Note 15 for more

details on available for sale investments.

Due to the insignificant amount of exposure to equity price risk, there are currently no outstanding

derivative financial instruments designated as hedges for these equity investments.

F74

Notes to the Consolidated Financial Statements (Continued)