Nokia 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

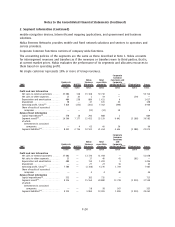

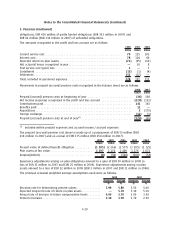

5. Pensions (Continued)

Pension Trust. In Germany, individual benefits are generally dependent on eligible compensation

levels, ranking within the Group and years of service. The majority of active employees in Nokia UK

participate in a pension scheme which is designed according to the Scheme Trust Deeds and Rules

and is compliant with the Guidelines of the UK Pension Regulator. The funding vehicle for the pension

scheme is the Nokia Group (UK) Pension Scheme Ltd which is run on a Trust basis. In the UK,

individual benefits are generally dependent on eligible compensation levels and years of service for

the defined benefit section of the scheme and on individual investment choices for the defined

contribution section of the scheme.”

In connection with the formation of Nokia Siemens Networks in 2007, the Group assumed multiple

pension plans reflected as acquisitions in the following tables.

The pension acts applying to wage and salary earners in private sectors in Finland, including the

former TEL Act, were combined on January 1, 2007 into one earningsrelated pensions act, the

Employee Pensions Act (TyEL). The change had no impact to the Group’s net pension asset in Finland.

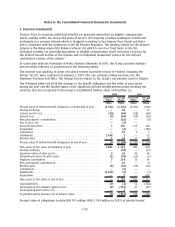

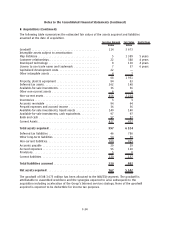

The following table sets forth the changes in the benefit obligation and fair value of plan assets

during the year and the funded status of the significant defined benefit pension plans showing the

amounts that are recognized in the Group’s consolidated balance sheet at December 31:

Domestic

Plans

Foreign

Plans

Domestic

Plans

Foreign

Plans

2008 2007

EURm EURm EURm EURm

Present value of defined benefit obligations at beginning of year . . . . (1 011) (1 255) (1 031) (546)

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —56—27

Current service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10) (69) (59) (66)

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9) (69) (50) (54)

Plan participants’ contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (10) — (8)

Past service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (2) ——

Actuarial gain (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 102 115 126

Acquisitions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (2) — (780)

Curtailment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —10 31

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 018 7 —15

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23411 30

Present value of defined benefit obligations at end of year . . . . . . . . . (7) (1 198) (1 011) (1 255)

Plan assets at fair value at beginning of year . . . . . . . . . . . . . . . . . . . 1 063 1 111 985 424

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (58) — (27)

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96249 46

Actuarial gain (loss) on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) (38) (33) (2)

Employer contribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 134 73 90

Plan participants’ contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —10—8

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) (22) (11) (30)

Curtailments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (5) ——

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1 076) (2) — (3)

Acquisitions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —5— 605

Plan assets at fair value at end of year . . . . . . . . . . . . . . . . . . . . . . . . — 1 197 1 063 1 111

Surplus/(Deficit). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7) (1) 52 (144)

Unrecognized net actuarial (gains) losses . . . . . . . . . . . . . . . . . . . . . . (2) (111) 97 (41)

Unrecognized past service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —1——

Prepaid/(Accrued) pension cost in balance sheet . . . . . . . . . . . . . . . . . (9) (111) 149 (185)

Present value of obligations include EUR 707 million (EUR 1 799 million in 2007) of wholly funded

F28

Notes to the Consolidated Financial Statements (Continued)