MasterCard 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

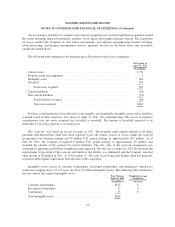

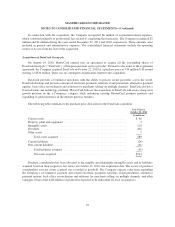

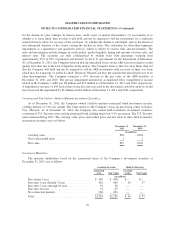

The distribution of the Company’s financial instruments which are measured at fair value on a recurring

basis within the Valuation Hierarchy was as follows:

December 31, 2011

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities 1..................... $— $ 393 $— $ 393

U.S. Government and Agency securities ...... — 205 — 205

Taxable short-term bond funds .............. 203 — — 203

Corporate securities ...................... — 325 — 325

Asset-backed securities ................... — 69 — 69

Auction rate securities .................... — — 70 70

Other .................................. — 22 — 22

Total .................................. $203 $1,014 $ 70 $1,287

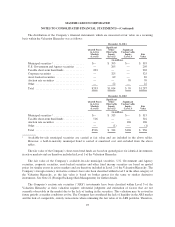

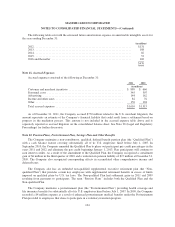

December 31, 2010

Quoted Prices

in Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair

Value

(in millions)

Municipal securities 1..................... $— $ 315 $— $ 315

Taxable short-term bond funds .............. 516 — — 516

Auction rate securities .................... — — 106 106

Other .................................. — (1) — (1)

Total .................................. $516 $ 314 $106 $ 936

1Available-for-sale municipal securities are carried at fair value and are included in the above tables.

However, a held-to-maturity municipal bond is carried at amortized cost and excluded from the above

tables.

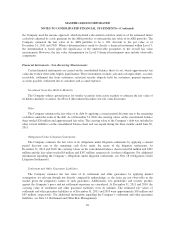

The fair value of the Company’s short-term bond funds are based on quoted prices for identical investments

in active markets and are therefore included in Level 1 of the Valuation Hierarchy.

The fair value of the Company’s available-for-sale municipal securities, U.S. Government and Agency

securities, corporate securities, asset-backed securities and other fixed income securities are based on quoted

prices for similar assets in active markets and are therefore included in Level 2 of the Valuation Hierarchy. The

Company’s foreign currency derivative contracts have also been classified within Level 2 in the other category of

the Valuation Hierarchy, as the fair value is based on broker quotes for the same or similar derivative

instruments. See Note 22 (Foreign Exchange Risk Management) for further details.

The Company’s auction rate securities (“ARS”) investments have been classified within Level 3 of the

Valuation Hierarchy as their valuation requires substantial judgment and estimation of factors that are not

currently observable in the market due to the lack of trading in the securities. This valuation may be revised in

future periods as market conditions evolve. The Company has considered the lack of liquidity in the ARS market

and the lack of comparable, orderly transactions when estimating the fair value of its ARS portfolio. Therefore,

95