MasterCard 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Availability

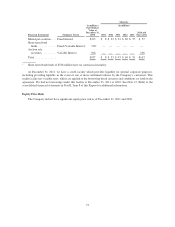

On November 22, 2011, the Company extended its committed unsecured revolving credit facility, dated as

of November 22, 2010 (the “Credit Facility”), for an additional year. The new expiration date of the Credit

Facility is November 21, 2014. The available funding under the Credit Facility will remain at $2.75 billion

through November 22, 2013 and then decrease to $2.35 billion during the final year of the Credit Facility

agreement. Other terms and conditions in the Credit Facility remain unchanged. The Company’s option to

request that each lender under the Credit Facility extend its commitment was provided pursuant to the original

terms of the Credit Facility agreement. MasterCard had no borrowings under the Credit Facility at December 31,

2011 and 2010.

Borrowings under the Credit Facility are available to provide liquidity for general corporate purposes,

including providing liquidity in the event of one or more settlement failures by the Company’s customers. In

addition, for business continuity planning and related purposes, we may borrow and repay amounts under the

Credit Facility from time to time. The facility fee and borrowing cost under the Credit Facility are contingent

upon the Company’s credit rating. At December 31, 2011, the applicable facility fee was 20 basis points on the

average daily commitment (whether or not utilized). In addition to the facility fee, interest on borrowings under

the Credit Facility would be charged at the London Interbank Offered Rate (LIBOR) plus an applicable margin of

130 basis points or an alternate base rate plus 30 basis points.

The Credit Facility contains customary representations, warranties and affirmative and negative covenants,

including a maximum level of consolidated debt to earnings before interest, taxes, depreciation and amortization

(EBITDA) financial covenant and events of default. MasterCard was in compliance with the covenants of the

Credit Facility at December 31, 2011 and 2010. The majority of Credit Facility lenders are customers or affiliates

of customers of MasterCard.

On November 4, 2009, the Company filed a universal shelf registration statement to provide additional

access to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time

offer to sell debt securities, preferred stock or Class A common stock in one or more offerings.

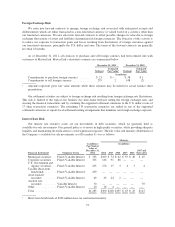

Off-Balance Sheet Arrangements

Other than settlement guarantees issued in the normal course of business, it is not our business practice to

enter into off-balance sheet arrangements, see Note 21 (Settlement and Other Risk Management) to the

consolidated financial statements included in Part II, Item 8 of this Report. MasterCard has no off-balance sheet

debt other than lease arrangements and other commitments as presented below in the future obligations table.

65