MasterCard 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our revenues depend heavily upon the overall level of consumer, business and government spending.

Changes in cardholder spending behavior, influenced by economic conditions, impact our ability to grow our

revenues. Our revenues are primarily impacted by the dollar volume of activity on cards and other devices that

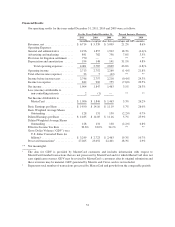

carry our brands, and the number of transactions. In 2011, volume-based revenues (domestic assessments and

cross-border volume fees) and transaction-based revenues (transaction processing fees) increased compared to

2010. In 2011, our processed transactions increased 18.3% and our volumes increased 16.1% on a local currency

basis. This compares to increased processed transactions of 2.9% and increased volumes of 9.1% on a local

currency basis in 2010. The net effects of pricing actions contributed approximately 2 percentage points to our

net revenue growth in 2011. During 2010, net pricing actions contributed approximately 5 percentage points to

our net revenue growth. These net pricing actions included the effects of price increases during 2009 and 2010,

which were partially offset by an increase in related cross-border rebates and the repeal of pricing relating to our

interim arrangement with the European Commission. Overall, net revenue growth for 2011 and 2010 was

moderated by an increase in rebates and incentives relating to customer and merchant agreement activity.

Rebates and incentives as a percentage of gross revenues were 24.9%, 26.7% and 24.1% in 2011, 2010 and 2009,

respectively.

Our operating expenses increased 43.6% in 2011 compared to 2010 primarily due to the MDL Provision and

greater general and administrative expenses, including higher personnel expenses to support the Company’s

strategic initiatives and personnel expenses related to recent acquisitions. Excluding the impact of the MDL

Provision specifically identified in the reconciliation table included in “—Operating Expenses,” operating

expenses increased 16.0% in 2011 compared to 2010. The net impact of foreign currency relating to the

translation of expenses from our functional currencies to U.S. dollars increased expenses by approximately 2

percentage points in 2011.

Our operating expenses decreased 1.8% in 2010 compared to 2009, primarily due to lower general and

administrative expenses, partially offset by increased advertising and marketing expenses. The decline in general

and administrative expenses was primarily due to lower personnel expenses, partially offset by increased

professional fees. The net foreign currency impact of changes in the U.S. dollar average exchange rates against

the euro and the Brazilian real reduced expenses by approximately 1 percentage point in 2010.

Our ratios of operating income as a percentage of net revenues, or operating margins, were 40.4%, 49.7%

and 44.3% in 2011, 2010 and 2009, respectively. Excluding the impact of the MDL Provision in 2011, our

operating margin was 51.9%. The effective income tax rates were 30.6%, 33.0% and 34.1% in 2011, 2010 and

2009, respectively.

On April 15, 2011, MasterCard acquired the prepaid card program management operations of

Travelex Holdings Ltd., since renamed Access Prepaid Worldwide (“Access”), at a purchase price of

295 million U.K. pound sterling, or $481 million, including adjustments for working capital, with contingent

consideration (an “earn-out”) of up to an additional 35 million U.K. pound sterling, or approximately $57

million, if certain performance targets were met. See Note 2 (Acquisitions) to the consolidated financial

statements included in Part II, Item 8 of this Report. Through Access, MasterCard manages and delivers

consumer and corporate prepaid travel cards through business partners around the world, including financial

institutions, retailers, travel agents and foreign exchange bureaus. Access enables us to offer end-to-end prepaid

card solutions encompassing branded switching, issuer processing and program management services, primarily

focused on the travel sector and in markets outside the United States.

On October 22, 2010 MasterCard acquired all the outstanding shares of DataCash Group plc (“DataCash”),

a payment service provider with operations in Europe and Brazil, at a purchase price of 334 million U.K. pound

sterling, or $534 million. DataCash provides e-Commerce merchants with the ability to process secure payments

across the world. DataCash develops and provides outsourced electronic payments solutions, fraud prevention,

alternative payment options, back-office reconciliation and solutions for merchants selling via multiple channels.

DataCash also has a fraud solutions and technology platform. MasterCard believes the acquisition of DataCash

will create a long-term growth platform in the e-Commerce category while enhancing existing MasterCard

payment products and expanding its global presence in the internet gateway business.

51