MasterCard 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Express’s U.S. Global Network Services billings during the quarter, up to a maximum of $150 million per

quarter. MasterCard recorded the present value of $1.8 billion, at a 5.75% discount rate, or $1.6 billion in the

quarter ended June 30, 2008. During the three months ended June 30, 2011, the Company made its final quarterly

payment of $150 million.

In 2003, MasterCard entered into a settlement agreement (the “U.S. Merchant Lawsuit Settlement”) related

to the U.S. merchant lawsuit described under the caption “U.S. Merchant and Consumer Litigations” in Note 20

(Legal and Regulatory Proceedings) and contract disputes with certain customers. Under the terms of the U.S.

Merchant Lawsuit Settlement, the Company was required to pay $125 million in 2003 and $100 million annually

each December from 2004 through 2012. On July 1, 2009, MasterCard entered into an agreement (the

“Prepayment Agreement”) with plaintiffs of the U.S. Merchant Lawsuit Settlement whereby MasterCard agreed

to make a prepayment of its remaining $400 million in payment obligations at a discounted amount of $335

million on September 30, 2009. The Company made the prepayment at the discounted amount of $335 million on

September 30, 2009, after the Prepayment Agreement became final.

See Note 20 (Legal and Regulatory Proceedings) for additional discussion regarding the Company’s legal

proceedings.

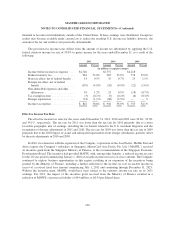

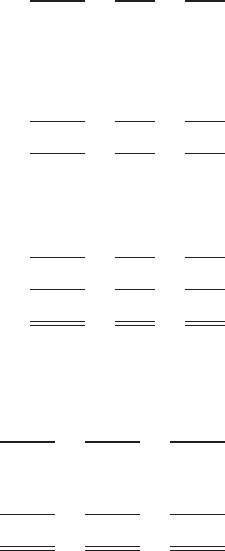

Note 19. Income Taxes

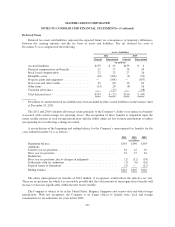

The total income tax provision for the years ended December 31 is comprised of the following components:

2011 2010 2009

(in millions)

Current

Federal ...................................................... $ 619 $379 $160

State and local ................................................ 30 17 18

Foreign ...................................................... 369 301 240

1,018 697 418

Deferred

Federal ...................................................... (155) 225 308

State and local ................................................ (6) 8 21

Foreign ...................................................... (15) (20) 8

(176) 213 337

Total income tax expense ........................................ $ 842 $910 $755

The domestic and foreign components of income before income taxes for the years ended December 31 are

as follows:

2011 2010 2009

(in millions)

United States .............................................. $1,415 $2,198 $1,482

Foreign ................................................... 1,331 559 736

Total income before income taxes .............................. $2,746 $2,757 $2,218

MasterCard has not provided for U.S. federal income and foreign withholding taxes on approximately $2

billion of undistributed earnings from non-U.S. subsidiaries as of December 31, 2011 because such earnings are

119