MasterCard 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Company does not provide for U.S. federal income tax and foreign withholding taxes on undistributed

earnings from non-U.S. subsidiaries when such earnings are intended to be reinvested indefinitely outside of the

U.S.

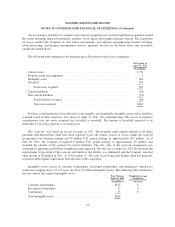

Revenue recognition—Revenues are recognized when persuasive evidence of an arrangement exists,

delivery has occurred or services have been rendered, the price is fixed or determinable, and collectibility is

reasonably assured. Revenues are generally based upon transactional information accumulated by our systems or

reported by our customers. The Company’s revenues are based on the volume of activity on cards that carry the

Company’s brands, the number of transactions processed or the nature of other payment-related services.

Volume-based revenues (domestic assessments and cross-border volume fees) are recorded as revenue in the

period they are earned, which is when the related volume is generated on the cards. Certain quarterly revenues

are estimated based upon aggregate transaction information and historical and projected customer quarterly

volumes. Actual results may differ from these estimates. Transaction-based revenues (transaction processing

fees) are calculated by multiplying the number and type of transactions by the specific price for each service.

Transaction-based fees are recognized as revenue in the same period as the related transactions occur. Other

payment-related services are dependent on the nature of the products or services provided to our customers and

are recognized as revenue in the same period as the related transactions occur or services are rendered.

MasterCard has business agreements with certain customers that provide for fee rebates when the customers

meet certain volume hurdles as well as other support incentives such as marketing, which are tied to

performance. Rebates and incentives are recorded as a reduction of revenue in the same period as the revenue is

earned or performance has occurred. Rebates and incentives are calculated on a monthly basis based upon

estimated performance and the terms of the related business agreements. In addition, MasterCard may incur costs

directly related to entering into such an agreement, which are deferred and amortized over the life of the

agreement.

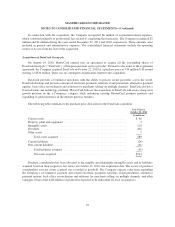

Pension and other postretirement plans—Compensation cost of an employee’s pension benefit is

recognized in general and administrative expenses on the projected unit credit method over the employee’s

approximate service period. The unit credit cost method is utilized for funding purposes.

The Company recognizes the overfunded or underfunded status of its single-employer defined benefit plan

or postretirement plan as an asset or liability in its balance sheet and recognizes changes in the funded status in

the year in which the changes occur through comprehensive income. The Company also measures the funded

status of a plan as of the date of its year-end balance sheet.

Share based payments—The Company recognizes the fair value of all share-based payments to employees

in its financial statements. The Company uses the straight-line method of attribution for expensing equity awards.

Compensation expense is recorded net of estimated forfeitures. Estimates are adjusted as appropriate. The

Company recognizes a realized tax benefit associated with dividends on certain equity shares and options as an

increase to additional paid-in capital. The benefit is included in the pool of excess tax benefits available to absorb

potential future tax liabilities on share based payment awards.

Advertising expense—The cost of media advertising is expensed when the advertising takes place.

Advertising production costs are expensed as incurred. Promotional items are expensed at the time the

promotional event occurs. Sponsorship costs are recognized over the period of benefit based on the estimated

value of certain events.

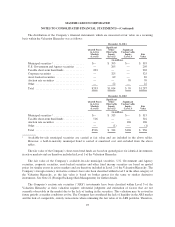

Foreign currency remeasurement and translation—The Company’s functional currencies include the U.S.

dollar, the euro, the Brazilian real, the Australian dollar, and the U.K. pound sterling. For foreign currency

87