MasterCard 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

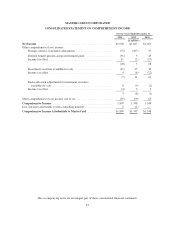

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

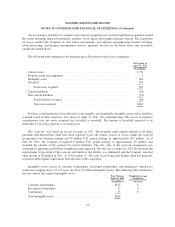

Access manages and delivers consumer and corporate prepaid travel cards through business partners around

the world, including financial institutions, retailers, travel agents and foreign exchange bureaus. The acquisition

of Access enables the Company to offer end-to-end prepaid card solutions encompassing branded switching,

issuer processing, and program management services, primarily focused on the travel sector and in markets

outside the United States.

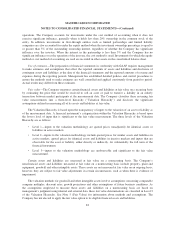

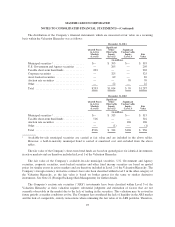

The following table summarizes the purchase price allocation for the Access acquisition:

Fair Value at

April 15, 2011

(in millions)

Current assets ........................................................... $ 50

Property, plant and equipment .............................................. 2

Intangible assets ......................................................... 164

Goodwill ............................................................... 354

Total assets acquired ................................................. 570

Current liabilities ........................................................ (56)

Non-current liabilities .................................................... (33)

Total liabilities assumed .............................................. (89)

Net assets acquired ................................................... $481

Purchase consideration has been allocated to the tangible and identifiable intangible assets and to liabilities

assumed based on their respective fair values on April 15, 2011, the acquisition date. The excess of purchase

consideration over net assets acquired was recorded as goodwill. The amount of goodwill expected to be

deductible for local tax purposes is not significant.

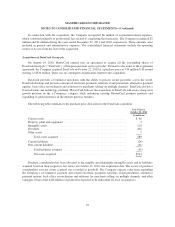

The “earn-out” was based on Access revenues in 2011. The potential undiscounted amount of all future

payments that MasterCard could have been required to pay the former owners of Access under the earn-out

arrangement was between nothing and 35 million U.K. pound sterling, or approximately $57 million. As of

June 30, 2011, the Company recognized 6 million U.K. pound sterling, or approximately $9 million, and

included the amount of the earn-out in current liabilities. The fair value of the earn-out arrangement was

estimated by applying a probability-weighted income approach. The full year revenues for 2011 did not meet the

requirements for payment of the earn-out and therefore the liability was eliminated and the Company recorded

other income of $9 million in 2011. As of December 31, 2011, the Access long-term business plan was generally

consistent with original expectations from the time of the acquisition.

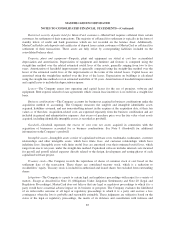

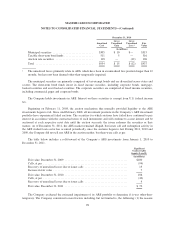

Intangible assets consist of customer relationships, developed technologies and tradenames, which have

useful lives ranging from 1.5 to 10 years. See Note 10 (Other Intangible Assets). The following table summarizes

the fair value of the acquired intangible assets: Fair Value at

April 15, 2011

Weighted-Average

Useful Life

(in millions) (in years)

Customer relationships .................................... $132 8

Developed technologies ................................... 17 4

Tradenames ............................................ 15 6

Total intangible assets .................................... $164

91