MasterCard 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

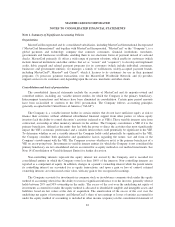

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

significant purchases and sales of financing receivables, aging information and credit quality indicators. The

Company adopted this accounting standard effective January 1, 2011, and the adoption did not have an impact on

the Company’s financial position or results of operations.

Impairment testing for goodwill—In December 2010, a new accounting standard was issued that requires

Step 2 of the goodwill impairment test to be performed for reporting units with zero or negative carrying amounts

if qualitative factors indicate that it is more likely than not that a goodwill impairment exists. The provisions for

this pronouncement are effective for fiscal years beginning after December 15, 2010, with no early adoption

permitted. The Company adopted this accounting standard on January 1, 2011, and the adoption did not have an

impact on the Company’s financial position or results of operations.

In September 2011, a new accounting standard was issued that is intended to simplify how an entity tests

goodwill for impairment. Entities are permitted to perform a qualitative assessment of goodwill impairment to

determine whether it is necessary to perform the two-step quantitative goodwill impairment test. This standard is

effective for goodwill impairment tests performed in interim and annual periods for fiscal years beginning after

December 15, 2011, with early adoption permitted. The Company adopted the revised accounting standard

effective October 1, 2011. The adoption did not have an impact on the Company’s financial position or results of

operations.

Business combinations—In December 2010, a new accounting standard was issued that requires a company

to disclose revenue and earnings of the combined entity as though the business combination that occurred during

the current year had occurred as of the beginning of the comparable prior annual reporting period, only when

comparative financial statements are presented. The disclosure provisions are effective prospectively for business

combinations for which the acquisition date is on or after the beginning of the first annual reporting period

beginning on or after December 15, 2010, with early adoption permitted. The Company adopted this accounting

standard on January 1, 2011, and the adoption did not have an impact on the Company’s financial position or

results of operations.

Comprehensive income—In June 2011, a new accounting standard was issued that amends existing guidance

by allowing only two options for presenting the components of net income and other comprehensive income:

(1) in a single continuous statement of comprehensive income or (2) in two separate but consecutive financial

statements, consisting of an income statement followed by a separate statement of other comprehensive income.

Also, items that are reclassified from other comprehensive income to net income must be presented on the face of

the financial statements. In December 2011, a new accounting standard was issued that indefinitely defers the

effective date for the requirement to present the reclassification of items from comprehensive income to net

income. Both standards require retrospective application, and are effective for fiscal years, and interim periods

within those years, beginning after December 15, 2011, with early adoption permitted. The Company will adopt

the revised accounting standards effective January 1, 2012, and does not anticipate that this adoption will have an

impact on the Company’s financial position or results of operations.

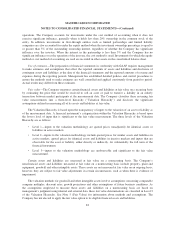

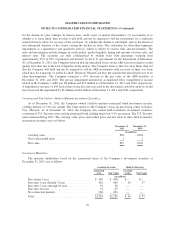

Note 2. Acquisitions

Acquisition of Card Program Management Operations

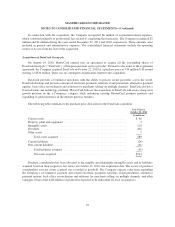

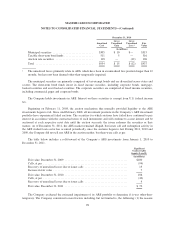

On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program

management operations of Travelex Holdings Ltd., since renamed Access Prepaid Worldwide (“Access”).

Pursuant to the terms of the acquisition agreement, the Company acquired Access on April 15, 2011, at a

purchase price of 295 million U.K. pound sterling, or $481 million, including adjustments for working capital,

and contingent consideration (an “earn-out”) of up to an additional 35 million U.K. pound sterling, or

approximately $57 million, if certain performance targets were met.

90