MasterCard 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

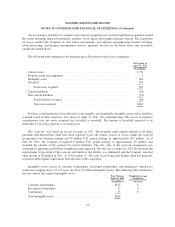

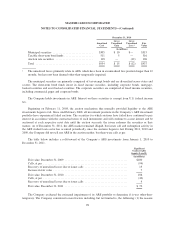

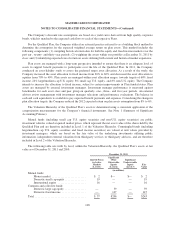

Other assets consisted of the following at December 31:

2011 2010

(in millions)

Customer and merchant incentives ......................................... $409 $386

Nonmarketable equity investments ......................................... 160 107

Income taxes receivable ................................................. 15 50

Other ................................................................ 46 47

Total other assets ....................................................... $630 $590

Certain customer and merchant business agreements provide incentives upon entering into the agreement.

Customer and merchant incentives represent payments made or amounts to be paid to customers and merchants

under business agreements. Amounts to be paid for these incentives and the related liability were included in

accrued expenses and other liabilities. Once the payment is made, the liability is relieved. Costs directly related

to entering into such an agreement are deferred and amortized over the life of the agreement.

Investments for which the equity method or historical cost method of accounting are used are recorded in

other assets on the consolidated balance sheet. The Company accounts for investments in common stock or

in-substance common stock under the equity method of accounting when it has the ability to exercise significant

influence over the investee, generally when it holds 20% or more of the common stock in the entity.

MasterCard’s share of net earnings or losses of entities accounted for under the equity method of accounting is

included in other income (expense) on the consolidated statement of operations. The Company accounts for

investments under the historical cost method of accounting when it does not exercise significant influence,

generally when it holds less than 20% ownership in the common stock of the entity.

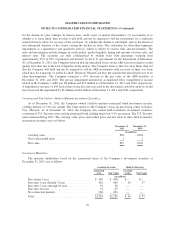

Note 8. Property, Plant and Equipment

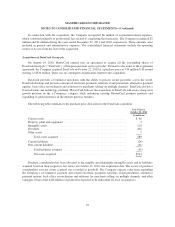

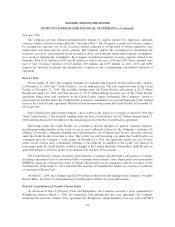

Property, plant and equipment consisted of the following at December 31:

2011 2010

(in millions)

Building and land ..................................................... $413 $402

Equipment ........................................................... 298 265

Furniture and fixtures .................................................. 53 50

Leasehold improvements ............................................... 55 54

Property, plant and equipment ........................................... 819 771

Less accumulated depreciation and amortization ............................. (370) (332)

Property, plant and equipment, net ........................................ $449 $439

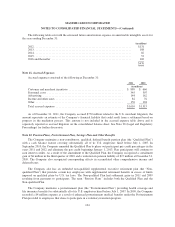

Effective March 1, 2009, MasterCard executed a ten-year lease between MasterCard, as tenant, and the

Missouri Development Finance Board (“MDFB”), as landlord, for MasterCard’s global technology and

operations center located in O’Fallon, Missouri, called Winghaven. See Note 14 (Consolidation of Variable

Interest Entity) for further discussion. The lease includes a bargain purchase option and is thus classified as a

capital lease. The building and land assets and capital lease obligation were recorded at $154 million which

represented the lesser of the present value of the minimum lease payments and the fair value of the building and

land assets at the inception of the lease. The Company received refunding revenue bonds issued by MDFB in the

same amount, $154 million, with the same payment terms as the capital lease and which contain the legal right of

101