MasterCard 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1www.mastercard.com

From left to right:

Ajay Banga

President and Chief Executive Of cer

Richard Haythornthwaite

Chairman of the Board of Directors

Drivers of Growth

Our business has global reach and has continued to

experience momentum. The components of our growth

can be broken into three primary drivers: trends in

personal consumption expenditure; movement from

paper-based transactions to electronic forms of payment;

and our share of electronic payments. Our emphasis

on these drivers is evident in our accomplishments as

we continue to grow, diversify and build our business.

We’re growing our business by making investments in

our product capabilities and business development.

We’ve secured key deals in the credit, debit, prepaid and

commercial space with Huntington, KeyBank, RBS Citizens,

Sovereign and SunTrust, just to name a few. In Mexico,

we partnered with the government and Banamex to launch

commercial credit programs. This is just a small sampling

of the inroads we have been making around the world.

We’re also diversifying our business by geographies and

customers. Examples include, but are not limited to,

our commercial alliance with China Union Pay; our U.K.

public sector procurement wins; our relationship with

Western Union, through which consumers around the

world can use our prepaid cards to transfer and spend

money; our renewed partnership with Poste Italiane,

which represents Europe’s largest social benefits card

program; and our alliance with Airtel Africa.

In addition, we’re building new businesses through

our Information Services; our acquisition of the prepaid

card program management business of Travelex (now

called Access Prepaid Worldwide); and our investment in

mFoundry, considered the most popular mobile banking

solution in the U.S.

As we strengthen our business, we remain mindful

of the Durbin Amendment and its potential impact on

us and our U.S. customers. As issuers and merchants

comply with the Federal Reserve rules, we’re confident

that our superior PIN debit offering will result in more

U.S. debit cards with our mark on them and new

opportunities to grow our debit business.

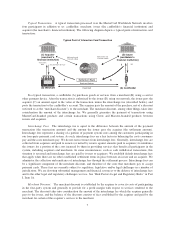

The Power of Innovation

Innovation is our focus—period. We’re building financial

inclusion and revolutionizing the way people pay, whether

by using our traditional cards, our Tap & Go™ PayPass

technology or mobile devices.

In 2011, we forged many strategic partnerships to

further drive innovation, including: Intel to secure online

payments; Isis to help foster increased usage of near

field communications (NFC) for mobile payments; and

Google, Sprint, Orange and Samsung Card to drive

commercialization in mobile.

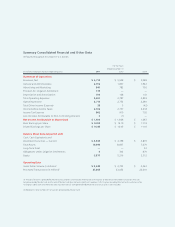

Dear Stockholders: On all fronts 2011 was a good year for MasterCard.

We delivered strong nancial results, including net revenue and earnings per

share growth, as well as solid operational performance, with annual gross

dollar volume, cross-border volume and processed transaction growth rates

in the mid- to high-teens. These results are especially gratifying considering

how economic uncertainty prevailed throughout the year. Also satisfying is

the fact that we are off to an excellent start against our 2011–2013 long-term

nancial performance objectives.