MasterCard 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

versus 2010 of $28 million was primarily due to a decrease in the interest accretion on litigation settlements and

an adjustment to the earnout related to the Company’s recent acquisition of Access (see Note 2 (Acquisitions) to

the consolidated financial statements included in Part II, Item 8 of this Report), partially offset by expenses from

equity method investments. The increase of total other income in 2010 versus 2009 of $47 million, was primarily

due to a decrease in interest expenses of $63 million resulting from a reduction in interest on litigation

settlements and on uncertain tax positions.

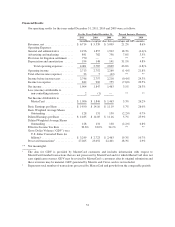

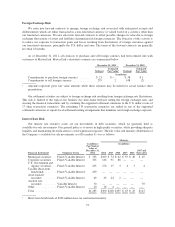

Income Taxes

The effective income tax rates for the years ended December 31, 2011, 2010 and 2009 were 30.6%, 33.0%

and 34.1%, respectively. The tax rate for 2011 was lower than the tax rate for 2010 primarily due to a more

favorable geographic mix of earnings, including the tax benefit related to the MDL Provision, and the recognition

of discrete adjustments in 2011 and 2010. The tax rate for 2010 was lower than the tax rate in 2009 primarily due

to the 2010 impact of actual and anticipated repatriations from foreign subsidiaries, partially offset by discrete

adjustments in 2010 and 2009.

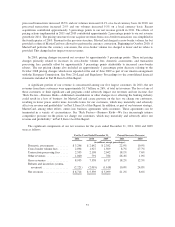

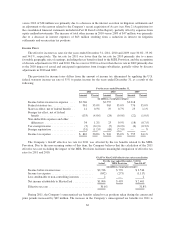

The provision for income taxes differs from the amount of income tax determined by applying the U.S.

federal statutory income tax rate of 35% to pretax income for the years ended December 31, as a result of the

following:

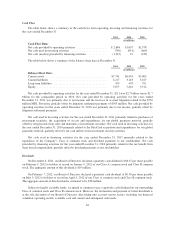

For the years ended December 31,

2011 2010 2009

Amount Percent Amount Percent Amount Percent

(in millions, except percentages)

Income before income tax expense .... $2,746 $2,757 $2,218

Federal statutory tax ................ 961 35.0% 965 35.0% 776 35.0%

State tax effect, net of federal benefit . . 14 0.5% 19 0.7% 25 1.1%

Foreign tax effect, net of federal

benefit ......................... (133) (4.9)% (24) (0.9)% (22) (1.0)%

Non-deductible expenses and other

differences ..................... 34 1.2% 23 0.9% (18) (0.7)%

Tax exempt income ................ (3) (0.1)% (5) (0.2)% (6) (0.3)%

Foreign repatriation ................ (31) (1.1)% (68) (2.5)% — — %

Income tax expense ................ $ 842 30.6% $ 910 33.0% $ 755 34.1%

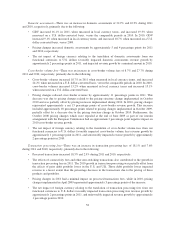

The Company’s GAAP effective tax rate for 2011 was affected by the tax benefits related to the MDL

Provision. Due to the non-recurring nature of this item, the Company believes that the calculation of the 2011

effective tax rate excluding the impact of the MDL Provision facilitates meaningful comparison of effective tax

rates for 2011 and 2010.

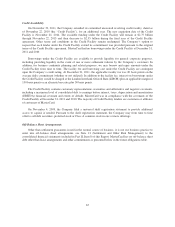

GAAP to Non-GAAP effective tax rate reconciliation

For the year ended December, 31 2011

Actual MDL Provision Non-GAAP

(in millions, except percentages)

Income before income taxes ...................... $2,746 $ 770 $ 3,516

Income tax expense ............................. (842) (275) (1,117)

Loss attributable to non-controlling interests ......... 2 — 2

Net income attributable to MasterCard .............. $1,906 $ 495 $ 2,401

Effective tax rate ............................... 30.6% 31.8%

During 2011, the Company’s unrecognized tax benefits related to tax positions taken during the current and

prior periods increased by $49 million. The increase in the Company’s unrecognized tax benefits for 2011 is

62