MasterCard 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

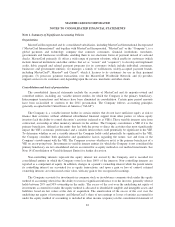

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

operations. The Company accounts for investments under the cost method of accounting when it does not

exercise significant influence, generally when it holds less than 20% ownership in the common stock of the

entity. In addition, investments in flow-through entities such as limited partnerships and limited liability

companies are also accounted for under the equity method when the investment ownership percentage is equal to

or greater than 5% of the outstanding ownership interest, regardless of whether the Company has significant

influence over the investee. When the interest in the partnership is less than 5% and the Company has no

significant influence over the operation of the investee, the cost method is used. Investments for which the equity

method or cost method of accounting are used are recorded in other assets on the consolidated balance sheet.

Use of estimates—The preparation of financial statements in conformity with GAAP requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and

expenses during the reporting periods. Management has established detailed policies and control procedures to

ensure the methods used to make estimates are well controlled and applied consistently from period to period.

Actual results may differ from these estimates.

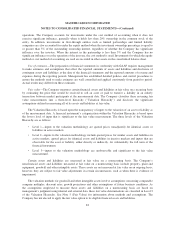

Fair value—The Company measures certain financial assets and liabilities at fair value on a recurring basis

by estimating the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. The Company classifies these recurring fair

value measurements into a three-level hierarchy (“Valuation Hierarchy”) and discloses the significant

assumptions utilized in measuring all of its assets and liabilities at fair value.

The Valuation Hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as

of the measurement date. A financial instrument’s categorization within the Valuation Hierarchy is based upon

the lowest level of input that is significant to the fair value measurement. The three levels of the Valuation

Hierarchy are as follows:

• Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or

liabilities in active markets.

• Level 2—inputs to the valuation methodology include quoted prices for similar assets and liabilities in

active markets, quoted prices for identical assets and liabilities in inactive markets and inputs that are

observable for the asset or liability, either directly or indirectly, for substantially the full term of the

financial instrument.

• Level 3—inputs to the valuation methodology are unobservable and significant to the fair value

measurement.

Certain assets and liabilities are measured at fair value on a nonrecurring basis. The Company’s

non-financial assets and liabilities measured at fair value on a nonrecurring basis include property, plant and

equipment, goodwill and other intangible assets. These assets are not measured at fair value on an ongoing basis;

however, they are subject to fair value adjustments in certain circumstances, such as when there is evidence of

impairment.

The valuation methods for goodwill and other intangible assets involve assumptions concerning comparable

company multiples, discount rates, growth projections and other assumptions of future business conditions. As

the assumptions employed to measure these assets and liabilities on a nonrecurring basis are based on

management’s judgment using internal and external data, these fair value determinations are classified in Level 3

of the Valuation Hierarchy. See Note 5 (Fair Value) for information about methods and assumptions. The

Company has not elected to apply the fair value option to its eligible financial assets and liabilities.

83