MasterCard 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MasterCard clears transactions among customers through our central and regional processing

systems. MasterCard clearing solutions can be managed with minimal system development,

which has enabled us to accelerate our customers’ ability to develop customized programs

and services. Fees for clearing are primarily paid by issuers.

c. Settlement. Once transactions have been authorized and cleared, MasterCard helps to settle

the transactions by facilitating the exchange of funds between parties. Once clearing is

completed, a daily reconciliation is provided to each customer involved in settlement,

detailing the net amounts by clearing cycle and a final settlement position. Fees for

settlement are primarily paid by issuers.

•Connectivity fees are charged to issuers and acquirers for network access, equipment and the

transmission of authorization and settlement messages. These fees are based on the size of the data

being transmitted through and the number of connections to the Company’s network.

4. Other revenues: Other revenues for other payment-related services are primarily dependent on the

nature of the products or services provided to our customers but are also impacted by other factors,

such as contractual agreements. Examples of other revenues are fees associated with the following:

•Fraud products and services used to prevent or detect fraudulent transactions. This includes warning

bulletin fees which are charged to issuers and acquirers for listing invalid or fraudulent accounts

either electronically or in paper form and for distributing this listing to merchants.

•Cardholder services fees are for benefits provided with MasterCard-branded cards, such as

insurance, telecommunications assistance for lost cards and locating automated teller machines.

•Consulting and research fees are primarily generated by MasterCard Advisors, the Company’s

professional advisory services group. The Company’s business agreements with certain customers

and merchants may include consulting services as an incentive. The contra-revenue associated with

these incentives is included in rebates and incentives.

•Program management services provided to prepaid card issuers. This primarily includes foreign

exchange margin, commissions, load fees, and ATM withdrawal fees paid by cardholders on the

sale and encashment of prepaid cards. See Note 2 (Acquisitions) to the consolidated financial

statements included in Part II, Item 8 of this Report for further discussion.

• The Company also charges for a variety of other payment-related services, including rules

compliance, account and transaction enhancement services, holograms and publications.

5. Rebates and incentives (contra-revenue): Rebates and incentives are provided to certain

MasterCard customers and are recorded as contra-revenue in the same period that performance occurs.

Performance periods vary depending on the type of rebate or incentive, including commitments to the

agreement term, hurdles for volumes, transactions or issuance of new cards, launch of new programs,

or the execution of marketing programs. Rebates and incentives are calculated based on estimated

performance, the timing of new and renewed agreements and the terms of the related business

agreements.

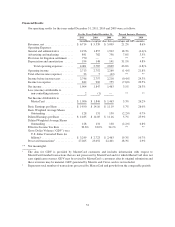

Revenue Analysis

In 2011 and 2010, gross revenues increased $1.4 billion and $841 million, or 18.2% and 12.5%,

respectively. Revenue growth in 2011 was primarily due to increased dollar volume of activity on cards carrying

our brands and increased transactions. Revenue growth in 2010 was primarily due to increased dollar volume of

activity on our cards carrying our brands, higher pricing and increased transactions. Rebates and incentives in

2011 and 2010 increased $202 and $401 million, or 10.0% and 24.8%, versus 2010 and 2009, respectively. Our

net revenues in 2011 and 2010 increased 21.2% and 8.6% versus 2010 and 2009, respectively.

Our revenues are primarily based on transactions and volumes, which are impacted by the number of

transactions and the dollar volume of activity on cards and other devices carrying our brands. In 2011, our

56