MasterCard 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

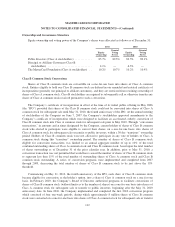

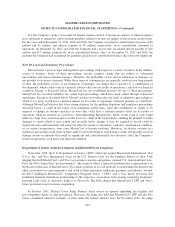

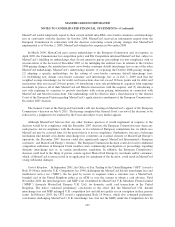

Deferred Taxes

Deferred tax assets and liabilities represent the expected future tax consequences of temporary differences

between the carrying amounts and the tax basis of assets and liabilities. The net deferred tax asset at

December 31 was comprised of the following:

Assets (Liabilities)

2011 2010

Current Non-current Current Non-current

(in millions)

Accrued liabilities ............................ $279 $ 26 $133 $ 4

Deferred compensation and benefits ............. 21 77 34 30

Stock based compensation ..................... 22 23 27 26

Intangible assets ............................. (10) (106) (6) (92)

Property, plant and equipment .................. — (108) — (107)

State taxes and other credits .................... 35 60 36 62

Other items ................................. (13) 20 (8) 26

Valuation allowances ......................... — (17) — (18)

Total deferred taxes 1......................... $334 $ (25) $216 $ (69)

1$9 million of current deferred tax liabilities has been included in other current liabilities on the balance sheet

at December 31, 2011.

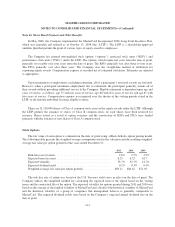

The 2011 and 2010 valuation allowances relate primarily to the Company’s ability to recognize tax benefits

associated with certain foreign net operating losses. The recognition of these benefits is dependent upon the

future taxable income in such foreign jurisdictions and the ability under tax law in these jurisdictions to utilize

net operating losses following a change in control.

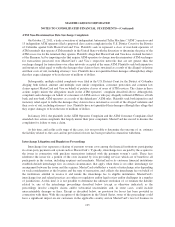

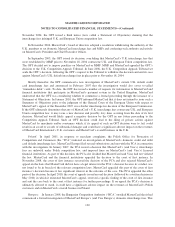

A reconciliation of the beginning and ending balance for the Company’s unrecognized tax benefits for the

years ended December 31, is as follows:

2011 2010 2009

(in millions)

Beginning balance ............................................... $165 $146 $163

Additions:

Current year tax positions ......................................... 34 22 19

Prior year tax positions ........................................... 23 15 10

Reductions:

Prior year tax positions, due to changes in judgments ................... (2) (12) (18)

Settlements with tax authorities .................................... (1) (6) (16)

Expired statute of limitations ...................................... (5) — (12)

Ending balance ................................................. $214 $165 $146

The entire unrecognized tax benefits of $214 million, if recognized, would reduce the effective tax rate.

There are no positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will

increase or decrease significantly within the next twelve months.

The Company is subject to tax in the United States, Belgium, Singapore and various state and other foreign

jurisdictions. With few exceptions, the Company is no longer subject to federal, state, local and foreign

examinations by tax authorities for years before 2002.

121