MasterCard 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

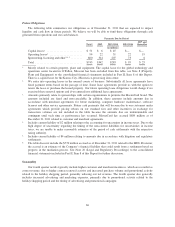

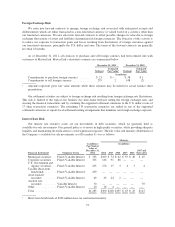

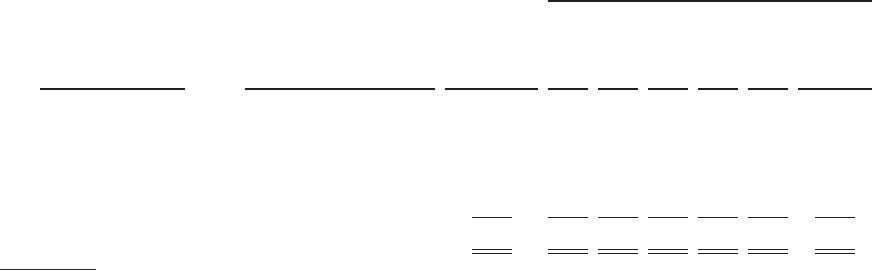

Maturity

(in millions) (in millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2010 2011 2012 2013 2014 2015

2016 and

there-after

Municipal securities . . . Fixed Interest $315 $ 8 $ 33 $ 93 $ 69 $ 55 $ 57

Short-term bond

funds ............. Fixed /Variable Interest15161————— —

Auction rate

securities ......... Variable Interest 106 ————— 106

Total ............... $937 $ 8 $ 33 $ 93 $ 69 $ 55 $163

1Short-term bond funds of $516 million have no contractual maturity.

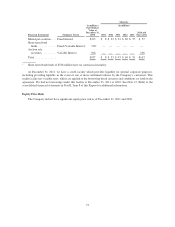

At December 31, 2011, we have a credit facility which provides liquidity for general corporate purposes,

including providing liquidity in the event of one or more settlement failures by the Company’s customers. This

credit facility has variable rates, which are applied to the borrowing based on terms and conditions set forth in the

agreement. We had no borrowings under this facility at December 31, 2011 or 2010. See Note 13 (Debt) to the

consolidated financial statements in Part II, Item 8 of this Report for additional information.

Equity Price Risk

The Company did not have significant equity price risk as of December 31, 2011 and 2010.

73