MasterCard 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

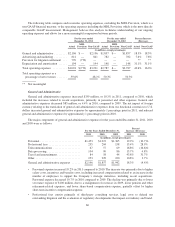

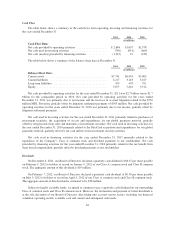

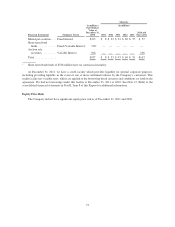

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

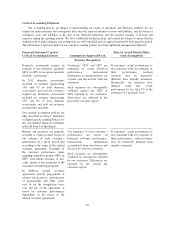

We determined that the majority of

our customer relationships, which

are intangible assets, have indefinite

lives. In addition to the impairment

testing noted above, we assess the

appropriateness of that indefinite

life annually.

We use internal data and

estimates regarding changes in

our customer relationships and

future cash flows to assess the

indefinite life and assess fair

value.

If a definite life is deemed to be

more appropriate, it would require

amortization of the customer

relationships which would result in

a reduction of future net income.

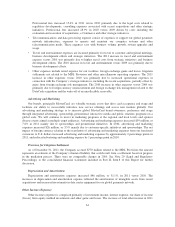

Recent Accounting Pronouncements

Revenue arrangements with multiple deliverables—In September 2009, the accounting standard for the

allocation of revenue in arrangements involving multiple deliverables was amended. Current accounting

standards require companies to allocate revenue based on the fair value of each deliverable, even though such

deliverables may not be sold separately either by the company itself or other vendors. The new accounting

standard eliminates (i) the residual method of revenue allocation and (ii) the requirement that all undelivered

elements must have objective and reliable evidence of fair value before a company can recognize the portion of

the overall arrangement fee that is attributable to items that already have been delivered. The Company adopted

the revised accounting standard effective January 1, 2011 via prospective adoption. The adoption did not have an

impact on the Company’s financial position or results of operations.

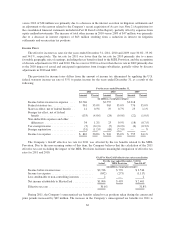

Fair value measurement and disclosure—The Company measures certain assets and liabilities at fair value

on a recurring basis by estimating the price that would be received to sell an asset or paid to transfer a liability in

an orderly transaction between market participants at the measurement date. The Company classifies these

recurring fair value measurements into a three-level hierarchy (“Valuation Hierarchy”) and discloses the

significant assumptions utilized in measuring assets and liabilities at fair value. In January 2010, fair value

disclosure requirements were amended to require detailed disclosures about transfers to and from Level 1 and 2

of the Valuation Hierarchy effective January 1, 2010 and disclosures regarding purchases, sales, issuances, and

settlements on a “gross” basis within the Level 3 (of the Valuation Hierarchy) reconciliation effective January 1,

2011. The Company adopted the new guidance for disclosures about transfers to and from Level 1 and 2 of the

Valuation Hierarchy effective January 1, 2010. The adoption did not have an impact on the Company’s financial

position or results of operations. The Company adopted the guidance that requires disclosure of a reconciliation

of purchases, sales, issuances, and settlements on a “gross” basis within Level 3 (of the Valuation Hierarchy)

effective January 1, 2011, as required, and the adoption did not have an impact on the Company’s financial

position or results of operations.

In May 2011, the fair value accounting standard was amended to change fair value measurement principles

and disclosure requirements. The key changes in measurement principles include limiting the concepts of highest

and best use and valuation premise to nonfinancial assets, providing a framework for considering whether a

premium or discount can be applied in a fair value measurement, and aligning the fair value measurement of

instruments classified within an entity’s shareholders’ equity with the guidance for liabilities. Disclosures will be

required for all transfers between Levels 1 and 2 within the Valuation Hierarchy, the use of a nonfinancial asset

measured at fair value if its use differs from its highest and best use, the level in the Valuation Hierarchy of

assets and liabilities not recorded at fair value but for which fair value is required to be disclosed, and for Level 3

measurements, quantitative information about unobservable inputs used, a description of the valuation processes

used, and qualitative discussion about the sensitivity of the measurements. The Company will adopt the revised

accounting standard effective January 1, 2012 via prospective adoption, as required, and does not anticipate that

this adoption will have an impact on the Company’s financial position or results of operations.

Disclosure about the Credit Quality of Financing Receivables and the Allowance for Credit Losses—In July

2010, a new accounting standard was issued that requires companies to provide more information about the credit

70