MasterCard 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

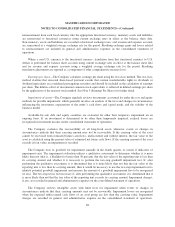

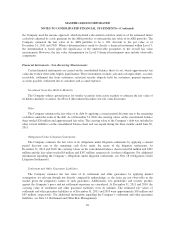

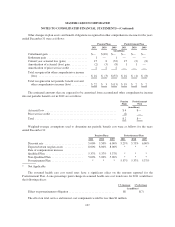

December 31, 2010

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss 1

Fair

Value

(in millions)

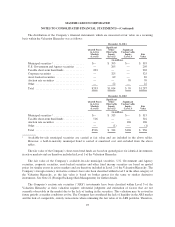

Municipal securities ............................ $305 $ 10 $— $315

Taxable short-term bond funds .................... 511 5 — 516

Auction rate securities .......................... 118 — (12) 106

Total ........................................ $934 $ 15 $ (12) $937

1The unrealized losses primarily relate to ARS, which have been in an unrealized loss position longer than 12

months, but have not been deemed other-than-temporarily impaired.

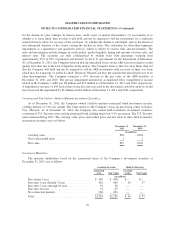

The municipal securities are primarily comprised of tax-exempt bonds and are diversified across states and

sectors. The short-term bond funds invest in fixed income securities, including corporate bonds, mortgage-

backed securities and asset-backed securities. The corporate securities are comprised of fixed income securities,

including commercial paper and corporate bonds.

The Company holds investments in ARS. Interest on these securities is exempt from U.S. federal income

tax.

Beginning on February 11, 2008, the auction mechanism that normally provided liquidity to the ARS

investments began to fail. Since mid-February 2008, all investment positions in the Company’s ARS investment

portfolio have experienced failed auctions. The securities for which auctions have failed have continued to pay

interest in accordance with the contractual terms of such instruments and will continue to accrue interest and be

auctioned at each respective reset date until the auction succeeds, the issuer redeems the securities or they

mature. As of December 31, 2011, the ARS market remained illiquid, but issuer call and redemption activity in

the ARS student loan sector has occurred periodically since the auctions began to fail. During 2011, 2010 and

2009, the Company did not sell any ARS in the auction market, but there were calls at par.

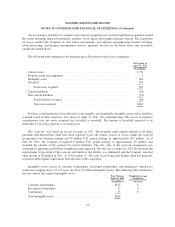

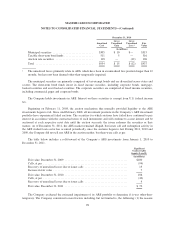

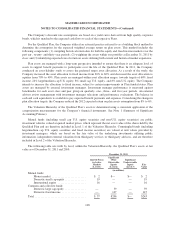

The table below includes a roll-forward of the Company’s ARS investments from January 1, 2010 to

December 31, 2011.

Significant

Unobservable

Inputs (Level 3)

(in millions)

Fair value, December 31, 2009 ............................................ $180

Calls, at par ........................................................... (94)

Recovery of unrealized losses due to issuer calls .............................. 13

Increase in fair value .................................................... 7

Fair value, December 31, 2010 ............................................ 106

Calls, at par ........................................................... (40)

Recovery of unrealized losses due to issuer calls .............................. 4

Fair value, December 31, 2011 ............................................ $ 70

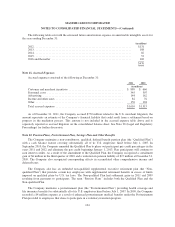

The Company evaluated the estimated impairment of its ARS portfolio to determine if it was other-than-

temporary. The Company considered several factors including, but not limited to, the following: (1) the reasons

98