MasterCard 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

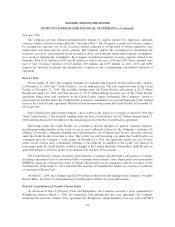

O’Fallon 1999 Trust (the “Trust”) as the lessor. The Trust, which was a variable interest entity, was established

for a single discrete purpose, was not an operating entity, had a limited life and had no employees. The Trust had

financed Winghaven through a combination of a third party equity investment in the amount of $5 million and

the issuance of 7.36% Series A Senior Secured Notes (the “Secured Notes”) with an aggregate principal amount

of $149 million and a maturity date of September 1, 2009. MasterCard International executed a guarantee of

85.15% of the aggregate principal amount of the Secured Notes outstanding, for a total of $127 million.

Additionally, upon the occurrence of specific events of default, MasterCard International guaranteed the

repayment of the total outstanding principal and interest on the Secured Notes and agreed to take ownership of

the facility. During 2004, MasterCard Incorporated became party to the guarantee and assumed certain covenant

compliance obligations, including financial reporting and maintenance of a certain level of consolidated net

worth. As the primary beneficiary of the Trust, the Company had consolidated the assets and liabilities of the

Trust in its consolidated financial statements.

Effective March 1, 2009, the aggregate outstanding principal and accrued interest on the Secured Notes was

repaid, the investor equity was redeemed, and the guarantee obligations of MasterCard International and

MasterCard Incorporated were terminated. The aggregate principal amount and interest plus a “make-whole”

amount repaid to the holders of Secured Notes and the equity investor was $165 million. The “make-whole”

amount of $5 million included in the repayment represented the discounted value of the remaining principal and

interest on the Secured Notes, less the outstanding principal balance and an equity investor premium. Also as a

result of the transaction, $154 million of short-term municipal bonds classified as held-to-maturity investments

were cancelled.

The Trust is no longer considered a variable interest entity and is no longer consolidated by the Company.

During the period when the Trust was a consolidated entity within the year ended December 31, 2009, its

operations had no impact on net income. However, interest income and interest expense were increased by $7

million in 2009. The Company did not provide any financial or other support that it was not contractually

required to provide during the year ended December 31, 2009.

The Company has additional investments in VIEs for which the Company is not the primary

beneficiary. These investments are not consolidated and are accounted for under the equity method of accounting

and recorded in other assets on the consolidated balance sheet.

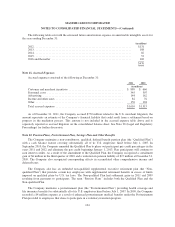

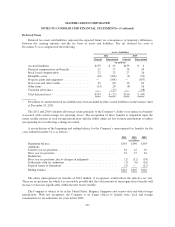

Note 15. Stockholders’ Equity

Classes of Capital Stock

MasterCard’s amended and restated certificate of incorporation authorizes the following classes of capital

stock:

Class

Par Value

Per Share

Authorized

Shares

(in millions) Dividend and Voting Rights

A $0.0001 3,000 One vote per share

Dividend rights

B $0.0001 1,200 Non-voting

Dividend rights

Preferred $0.0001 300 No shares issued or outstanding at December 31, 2011 and 2010,

respectively. Dividend and voting rights are to be determined by the

Board of Directors of the Company upon issuance.

111