MasterCard 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

offset with the capital lease. The Company has netted its investment in the MDFB refunding revenue bonds and

the corresponding capital lease obligation in the consolidated balance sheet. The related leasehold improvements

for Winghaven will continue to be amortized over the economic life of the improvements.

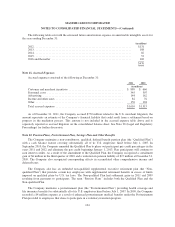

As of December 31, 2011 and 2010, capital leases, excluding the Winghaven facility, of $21 million and

$13 million, respectively, were included in equipment. Accumulated amortization of these capital leases was $10

million and $7 million as of December 31, 2011 and 2010, respectively.

Depreciation expense for the above property, plant and equipment, including amortization for capital leases,

was $77 million, $70 million and $76 million for the years ended December 31, 2011, 2010 and 2009,

respectively.

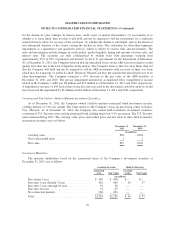

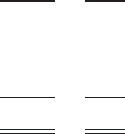

Note 9. Goodwill

The changes in the carrying amount of goodwill for the years ended December 31, 2011 and 2010 were as

follows:

2011 2010

(in millions)

Beginning balance .................................................... $ 677 $309

Goodwill acquired during the year ........................................ 354 402

Foreign currency translation ............................................ (17) (34)

Ending balance ....................................................... $1,014 $677

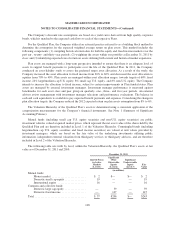

On April 15, 2011, MasterCard acquired Access. The Company allocated $354 million to goodwill as part

of the acquisition of Access. During 2010, the Company recognized $402 million of goodwill in connection with

its acquisition of DataCash. See Note 2 (Acquisitions) for further details.

The Company had no accumulated impairment losses for goodwill at December 31, 2011 or 2010. Based on

annual impairment testing, the Company’s reporting unit is not at significant risk of material goodwill

impairment.

102