MasterCard 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

intended to be reinvested indefinitely outside of the United States. If these earnings were distributed, foreign tax

credits may become available under current law to reduce the resulting U.S. income tax liability; however, the

amount of the tax and credits is not practically determinable.

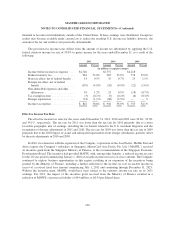

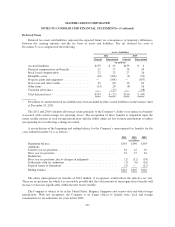

The provision for income taxes differs from the amount of income tax determined by applying the U.S.

federal statutory income tax rate of 35.0% to pretax income for the years ended December 31, as a result of the

following:

2011 2010 2009

Amount Percent Amount Percent Amount Percent

(in millions, except percentages)

Income before income tax expense .... $2,746 $2,757 $2,218

Federal statutory tax ................ 961 35.0% 965 35.0% 776 35.0%

State tax effect, net of federal benefit . . 14 0.5% 19 0.7% 25 1.1%

Foreign tax effect, net of federal

benefit ......................... (133) (4.9)% (24) (0.9)% (22) (1.0)%

Non-deductible expenses and other

differences ..................... 34 1.2% 23 0.9% (18) (0.7)%

Tax exempt income ................ (3) (0.1)% (5) (0.2)% (6) (0.3)%

Foreign repatriation ................ (31) (1.1)% (68) (2.5)% — — %

Income tax expense ................ $ 842 30.6% $ 910 33.0% $ 755 34.1%

Effective Income Tax Rate

The effective income tax rates for the years ended December 31, 2011, 2010 and 2009 were 30.6%, 33.0%

and 34.1%, respectively. The tax rate for 2011 was lower than the tax rate for 2010 primarily due to a more

favorable geographic mix of earnings, including the tax benefit related to the U.S. merchant litigation, and the

recognition of discrete adjustments in 2011 and 2010. The tax rate for 2010 was lower than the tax rate in 2009

primarily due to the 2010 impact of actual and anticipated repatriations from foreign subsidiaries, partially offset

by discrete adjustments in 2010 and 2009.

In 2010, in connection with the expansion of the Company’s operations in the Asia Pacific, Middle East and

Africa region, the Company’s subsidiary in Singapore, MasterCard Asia Pacific Pte. Ltd. (“MAPPL”) received

an incentive grant from the Singapore Ministry of Finance, at the recommendation of the Singapore Economic

Development Board. The incentive had provided MAPPL with, among other benefits, a reduced income tax rate

for the 10-year period commencing January 1, 2010 on taxable income in excess of a base amount. The Company

continued to explore business opportunities in this region, resulting in an expansion of the incentives being

granted by the Ministry of Finance, including a further reduction to the income tax rate on taxable income in

excess of a revised fixed base amount commencing July 1, 2011 and continuing through December 31, 2025.

Without the incentive grant, MAPPL would have been subject to the statutory income tax rate on its 2011

earnings. For 2011, the impact of the incentive grant received from the Ministry of Finance resulted in a

reduction of MAPPL’s income tax liability of $44 million, or $0.34 per diluted share.

120