MasterCard 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

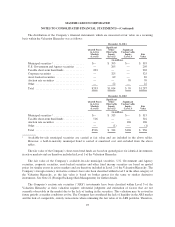

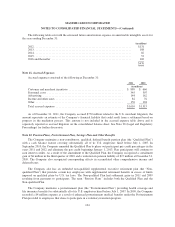

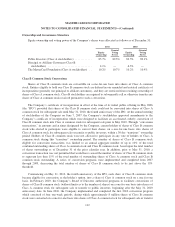

The following table sets forth the estimated future amortization expense on amortizable intangible assets for

the years ending December 31:

(in millions)

2012 .................................................................... $131

2013 .................................................................... 108

2014 .................................................................... 82

2015 .................................................................... 53

2016 and thereafter ........................................................ 102

$476

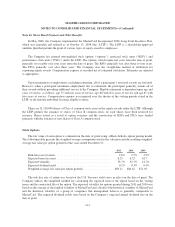

Note 11. Accrued Expenses

Accrued expenses consisted of the following at December 31:

2011 2010

(in millions)

Customer and merchant incentives ...................................... $ 889 $ 666

Personnel costs ..................................................... 345 307

Advertising ........................................................ 144 162

Income and other taxes ............................................... 82 76

Other ............................................................. 150 104

Total accrued expenses ............................................... $1,610 $1,315

As of December 31, 2011, the Company accrued $770 million related to the U.S. merchant litigation; the

amount represents an estimate of the Company’s financial liability that could result from a settlement based on

progress in the mediation process. This amount is not included in the accrued expense table above and is

separately reported as accrued litigation on the consolidated balance sheet. See Note 20 (Legal and Regulatory

Proceedings) for further discussion.

Note 12. Pension Plans, Postretirement Plan, Savings Plan and Other Benefits

The Company maintains a non-contributory, qualified, defined benefit pension plan (the “Qualified Plan”)

with a cash balance feature covering substantially all of its U.S. employees hired before July 1, 2007. In

September 2010, the Company amended the Qualified Plan to phase out participant pay credit percentages in the

years 2011 and 2012 and eliminate the pay credit beginning January 1, 2013. Plan participants will continue to

earn interest credits. As a result of the amendment to the Qualified Plan, the Company recognized a curtailment

gain of $6 million in the third quarter of 2010 and a reduction in pension liability of $17 million at December 31,

2010. The Company also recognized corresponding effects in accumulated other comprehensive income and

deferred taxes.

The Company also has an unfunded non-qualified supplemental executive retirement plan (the “Non-

qualified Plan”) that provides certain key employees with supplemental retirement benefits in excess of limits

imposed on qualified plans by U.S. tax laws. The Non-qualified Plan had settlement gains in 2011 and 2009

resulting from payments to participants. The term “Pension Plans” includes both the Qualified Plan and the

Non-qualified Plan.

The Company maintains a postretirement plan (the “Postretirement Plan”) providing health coverage and

life insurance benefits for substantially all of its U.S. employees hired before July 1, 2007. In 2009, the Company

recorded a $4 million expense as a result of enhanced postretirement medical benefits under the Postretirement

Plan provided to employees that chose to participate in a voluntary transition program.

104