MasterCard 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

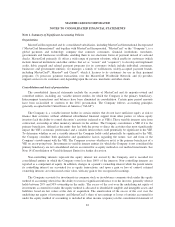

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Summary of Significant Accounting Policies

Organization

MasterCard Incorporated and its consolidated subsidiaries, including MasterCard International Incorporated

(“MasterCard International” and together with MasterCard Incorporated, “MasterCard” or the “Company”), is a

global payments and technology company that connects consumers, financial institutions, merchants,

governments and businesses worldwide, enabling them to use electronic forms of payment instead of cash and

checks. MasterCard primarily (1) offers a wide range of payment solutions, which enable its customers (which

include financial institutions and other entities that act as “issuers” and “acquirers”) to develop and implement

credit, debit, prepaid and related payment programs for its customers (which include individual consumers,

businesses and government entities); (2) manages a family of well-known, widely-accepted payment brands,

including MasterCard®, Maestro®and Cirrus®, which it licenses to its customers for use in their payment

programs; (3) processes payment transactions over the MasterCard Worldwide Network; and (4) provides

support services to its customers and, depending upon the service, merchants and other clients.

Consolidation and basis of presentation

The consolidated financial statements include the accounts of MasterCard and its majority-owned and

controlled entities, including any variable interest entities for which the Company is the primary beneficiary.

Intercompany transactions and balances have been eliminated in consolidation. Certain prior period amounts

have been reclassified to conform to the 2011 presentation. The Company follows accounting principles

generally accepted in the United States of America (“GAAP”).

The Company is a variable interest holder in certain entities that do not have sufficient equity at risk to

finance their activities without additional subordinated financial support from other parties or whose equity

investors lack the ability to control the entity’s activities (referred to as VIEs). These variable interests arise from

contractual, ownership or other monetary interests in the entities. The Company consolidates a VIE if it is the

primary beneficiary, defined as the entity that has both the power to direct the activities that most significantly

impact the VIE’s economic performance and a variable interest that could potentially be significant to the VIE.

To determine whether or not a variable interest the Company holds could potentially be significant to the VIE,

the Company considers both qualitative and quantitative factors regarding the nature, size and form of the

Company’s involvement with the VIE. The Company assesses whether or not it is the primary beneficiary of a

VIE on an on-going basis. Investments in variable interest entities for which the Company is not considered the

primary beneficiary are not consolidated and are accounted for as equity method or cost method investments. See

Note 14 (Consolidation of Variable Interest Entity) for further discussion.

Non-controlling interests represent the equity interest not owned by the Company and is recorded for

consolidated entities in which the Company owns less than 100% of the interests. Non-controlling interests are

reported as a component of equity. In addition, changes in a parent’s ownership interest while the parent retains

its controlling interest are accounted for as equity transactions, and upon a gain or loss of control, retained

ownership interests are remeasured at fair value, with any gain or loss recognized in earnings.

The Company accounts for investments in common stock or in-substance common stock under the equity

method of accounting when it has the ability to exercise significant influence over the investee, generally when it

holds between 20% and 50% ownership in the entity. The excess of the cost over the underlying net equity of

investments accounted for under the equity method is allocated to identifiable tangible and intangible assets and

liabilities based on fair values at the date of acquisition. The amortization of the excess of the cost over the

underlying net equity of investments and MasterCard’s share of net earnings or losses of entities accounted for

under the equity method of accounting is included in other income (expense) on the consolidated statement of

82