MasterCard 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

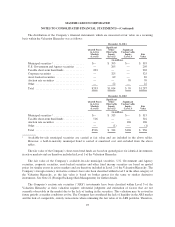

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Restricted security deposits held for MasterCard customers—MasterCard requires collateral from certain

customers for settlement of their transactions. The majority of collateral for settlement is typically in the form of

standby letters of credit and bank guarantees which are not recorded on the balance sheet. Additionally,

MasterCard holds cash deposits and certificates of deposit from certain customers of MasterCard as collateral for

settlement of their transactions. These assets are fully offset by corresponding liabilities included on the

consolidated balance sheet.

Property, plant and equipment—Property, plant and equipment are stated at cost less accumulated

depreciation and amortization. Depreciation of equipment and furniture and fixtures is computed using the

straight-line method over the related estimated useful lives of the assets, generally ranging from two to five

years. Amortization of leasehold improvements is generally computed using the straight-line method over the

lesser of the estimated useful lives of the improvements or the terms of the related leases. Capital leases are

amortized using the straight-line method over the lives of the leases. Depreciation on buildings is calculated

using the straight-line method over an estimated useful life of 30 years. Amortization of leasehold improvements

and capital leases is included in depreciation expense.

Leases—The Company enters into operating and capital leases for the use of premises, software and

equipment. Rent expense related to lease agreements which contain lease incentives is recorded on a straight-line

basis.

Business combinations—The Company accounts for businesses acquired in business combinations under the

acquisition method of accounting. The Company measures the tangible and intangible identifiable assets

acquired, liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, at their fair

values as of that date. Acquisition-related costs are expensed separately from the business combination and are

included in general and administrative expenses. Any excess of purchase price over the fair value of net assets

acquired, including identifiable intangible assets, is recorded as goodwill.

Goodwill—Goodwill represents the excess of cost over net assets acquired in connection with the

acquisition of businesses accounted for as business combinations. See Note 9 (Goodwill) for additional

information on the Company’s goodwill.

Intangible assets—Intangible assets consist of capitalized software costs, trademarks, tradenames, customer

relationships and other intangible assets, which have finite lives, and customer relationships which have

indefinite lives. Intangible assets with finite useful lives are amortized over their estimated useful lives, which

range from one to ten years, under the straight-line method. Capitalized software includes internal costs incurred

for payroll and payroll related expenses directly related to the design, development and testing phases of each

capitalized software project.

Treasury stock—The Company records the repurchase of shares of common stock at cost based on the

settlement date of the transaction. These shares are considered treasury stock, which is a reduction to

stockholders’ equity. Treasury stock is included in authorized and issued shares but excluded from outstanding

shares.

Litigation—The Company is a party to certain legal and regulatory proceedings with respect to a variety of

matters. Except as described in Note 18 (Obligations Under Litigation Settlements) and Note 20 (Legal and

Regulatory Proceedings), MasterCard does not believe that any legal or regulatory proceedings to which it is a

party would have a material adverse impact on its business or prospects. The Company evaluates the likelihood

of an unfavorable outcome of all legal or regulatory proceedings to which it is a party and accrues a loss

contingency when the loss is probable and reasonably estimable. These judgments are subjective based on the

status of the legal or regulatory proceedings, the merits of its defenses and consultation with in-house and

85