MasterCard 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

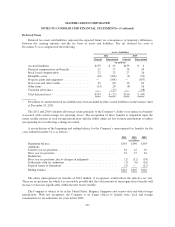

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

followed an informal investigation that the HCA had been conducting since the middle of 2007. In July 2009, the

HCA issued to MasterCard a Preliminary Position that MasterCard Europe’s historic domestic interchange fees

violate Hungarian competition law. MasterCard responded to the Preliminary Position both in writing and at a

hearing which was held in September 2009. Subsequently in September 2009, the HCA ruled that MasterCard’s

(and Visa’s) historic interchange fees violated the law and fined each of MasterCard Europe and Visa Europe

approximately $3 million, which was paid during the fourth quarter of 2009. In December 2009, the HCA issued

its formal decision and MasterCard appealed the decision to the Hungarian courts. In September 2010, the HCA

filed its reply to MasterCard’s appeal, while MasterCard filed its response in October 2010. In October 2010, the

Hungarian appeals court stayed the proceeding until MasterCard’s appeal to the General Court of the European

Union of the European Commission’s December 2007 cross-border interchange fee decision is finally decided. If

the HCA’s decision is not reversed on appeal, it could have a significant adverse impact on the revenues of

MasterCard’s Hungarian customers and on MasterCard’s overall business in Hungary.

Italy. In July 2009, the Italian Competition Authority (“ICA”) commenced a proceeding against

MasterCard and a number of its customers concerning MasterCard Europe’s domestic interchange fees in Italy.

MasterCard, as well as each of the banks involved in the proceeding, offered to give certain undertakings to the

ICA, which were rejected (which rejection MasterCard appealed to the Administrative Court). In May 2010, the

ICA issued a Statement of Objections to MasterCard and the banks. In November 2010, the ICA adopted a

decision in which it determined that MasterCard Europe’s domestic interchange fees violate European Union

competition law, fined MasterCard 2.7 million euro (approximately $4 million) and ordered MasterCard to

refrain in the future from maintaining interchange fees that are not based on economic justifications linked to

efficiency criteria and to eliminate any anticompetitive clauses from its licensing agreements. MasterCard

appealed the ICA’s infringement decision to the Administrative Court. Subsequently, in November 2010, the

Administrative Court announced its judgment that the ICA had improperly rejected MasterCard’s proposed

undertakings and annulled the ICA’s undertakings decision (which judgment the ICA appealed to the Council of

State). In May 2011, the General Court overturned the Administrative Court’s undertakings judgment on

procedural grounds and MasterCard refiled its undertakings appeal as part of its appeal of the ICA infringement

decision. In July 2011, the Administrative Court again issued a judgment that the ICA had improperly rejected

MasterCard’s proposed undertakings and annulled for a second time the ICA’s undertakings decision and, on that

basis, also annulled the ICA’s infringement decision. The ICA has appealed the Administrative Court’s most

recent judgment to the Council of State. If the Administrative Court’s second judgment is overturned, it is likely

that the Administrative Court would reconsider MasterCard’s appeal of the ICA’s infringement decision. If the

ICA’s infringement decision is not reversed on appeal, the ICA’s decision could have a significant adverse

impact on the revenues of MasterCard’s Italian customers and on MasterCard’s overall business in Italy.

Canada. In December 2010, the Canadian Competition Bureau (the “CCB”) filed an application with the

Canadian Competition Tribunal to strike down certain MasterCard rules related to interchange fees, including the

“honor all cards” and “no surcharge” rules. Also in December 2010, MasterCard learned that a purported class

action lawsuit had been commenced against it in Quebec on behalf of Canadian merchants and consumers. That

suit essentially repeats the allegations and arguments of the CCB application to the Canadian Competition

Tribunal and seeks compensatory and punitive damages in unspecified amounts, as well as injunctive relief. In

March 2011, a second purported class action lawsuit was commenced in British Columbia against MasterCard,

Visa and a number of large Canadian banks, and in May 2011 a third purported class action lawsuit was

commenced in Ontario against the same defendants. These suits allege that MasterCard, Visa and the banks have

engaged in a price fixing conspiracy to increase or maintain the fees paid by merchants on credit card

transactions and that MasterCard’s and Visa’s rules force merchants to accept all MasterCard and Visa credit

cards and prevent merchants from charging more for payments with MasterCard and Visa premium cards. The

second suit seeks compensatory damages in unspecified amounts, and the third suit seeks compensatory damages

of $5 billion. The second and third suits also seek punitive damages in unspecified amounts, as well as injunctive

131