MasterCard 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

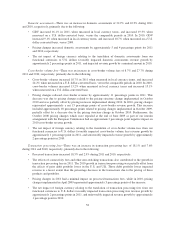

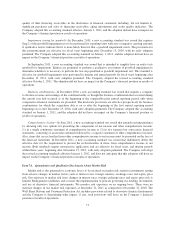

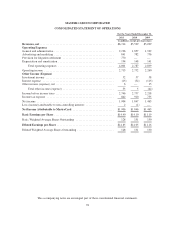

Financial Statement Caption/

Critical Accounting Estimate Assumptions/Approach Used

Effect if Actual Results Differ

from Assumptions

Legal and Regulatory Matters

We are party to legal and regulatory

proceedings with respect to a

variety of matters. Except as

described in Note 18 (Obligations

Under Litigation Settlements) and

Note 20 (Legal and Regulatory

Proceedings) to the consolidated

financial statements in Part II,

Item 8 of this Report, MasterCard

does not believe that any legal or

regulatory proceedings to which it is

a party would have a material

adverse impact on its business or

prospects.

We evaluate the likelihood of an

unfavorable outcome of the legal

or regulatory proceedings to which

we are party. Our judgments are

subjective based on the status of

the legal or regulatory

proceedings, the merits of our

defenses and consultation with in-

house and outside legal counsel.

Due to the inherent uncertainties of

the legal and regulatory process in

the multiple jurisdictions in which

we operate, our judgments may be

materially different than the actual

outcomes.

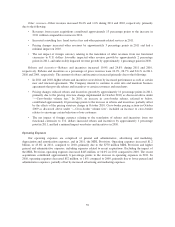

Income Taxes

In calculating our effective tax rate,

we need to make estimates

regarding the timing and amount of

taxable and deductible items which

will adjust the pretax income earned

in various tax jurisdictions.

Through our interpretation of local

tax regulations, adjustments to

pretax income for income earned

in various tax jurisdictions are

reflected within various tax filings.

Although we believe that our

estimates and judgments discussed

herein are reasonable, actual results

may be materially different than the

estimated amounts.

We record a valuation allowance to

reduce our deferred tax assets to the

amount that is more likely than not

to be realized.

We consider projected future

taxable income and ongoing tax

planning strategies in assessing the

need for the valuation allowance.

If it is determined that we are able

to realize deferred tax assets in

excess of the net carrying value or

to the extent we are unable to

realize a deferred tax asset, we

would adjust the valuation

allowance with a corresponding

increase or decrease to earnings.

We record tax liabilities for

uncertain tax positions taken, or

expected to be taken, which may not

be sustained or may only be

partially sustained, upon

examination by the relevant taxing

authorities.

We consider all relevant facts and

current authorities in the tax law in

assessing whether any benefit

resulting from an uncertain tax

position was more likely than not

to be sustained and, if so, how

current law impacts the amount

reflected within these financial

statements.

If upon examination, we realize a

tax benefit which is not fully

sustained or is more favorably

sustained, this would decrease or

increase earnings in the period. In

certain situations, the Company will

have offsetting tax credits or taxes

in other jurisdictions.

We do not record U.S. income tax

expense for foreign earnings which

we intend to reinvest indefinitely to

expand our international operations.

We consider business plans,

planning opportunities, and

expected future outcomes in

assessing the needs for future

expansion and support of our

international operations.

If our business plans change or our

future outcomes differ from our

expectations, U.S. income tax

expense and our effective tax rate

could increase or decrease in that

period.

68