MasterCard 2011 Annual Report Download - page 131

Download and view the complete annual report

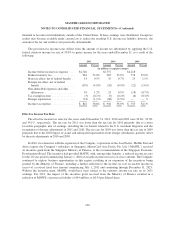

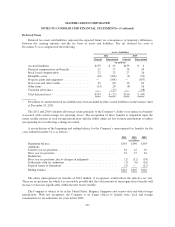

Please find page 131 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

In July 2006, the group of purported class plaintiffs filed a supplemental complaint alleging that

MasterCard’s initial public offering of its Class A Common Stock in May 2006 (the “IPO”) and certain purported

agreements entered into between MasterCard and its member financial institutions in connection with the IPO:

(1) violate Section 7 of the Clayton Act because their effect allegedly may be to substantially lessen competition,

(2) violate Section 1 of the Sherman Act because they allegedly constitute an unlawful combination in restraint

of trade and (3) constitute a fraudulent conveyance because the member banks are allegedly attempting to release

without adequate consideration from the member banks MasterCard’s right to assess the member banks for

MasterCard’s litigation liabilities in these interchange-related litigations and in other antitrust litigations pending

against it. The plaintiffs seek unspecified damages and an order reversing and unwinding the IPO. In September

2006, MasterCard moved to dismiss all of the claims contained in the supplemental complaint. In November

2008, the district court granted MasterCard’s motion to dismiss the plaintiffs’ supplemental complaint in its

entirety with leave to file an amended complaint. In January 2009, the class plaintiffs repled their complaint

directed at MasterCard’s IPO by filing a First Amended Supplemental Class Action Complaint. The causes of

action in the complaint generally mirror those in the plaintiffs’ original IPO-related complaint although the

plaintiffs have attempted to expand their factual allegations based upon discovery that has been garnered in the

case. The class plaintiffs seek treble damages and injunctive relief including, but not limited to, an order

reversing and unwinding the IPO. In March 2009, MasterCard filed a motion to dismiss the First Amended

Supplemental Class Action Complaint in its entirety. The parties have fully briefed the motion to dismiss and the

court heard oral argument on the motion in November 2009. The parties are awaiting a decision on the motion. In

July 2009, the class plaintiffs and individual plaintiffs served confidential expert reports detailing the plaintiffs’

theories of liability and alleging damages in the tens of billions of dollars. The defendants served their expert

reports in December 2009 rebutting the plaintiffs’ assertions both with respect to liability and damages. In

February 2011, both the defendants and the plaintiffs served a number of dispositive motions seeking summary

judgment on all or portions of the claims in the complaints. The parties have fully briefed on the motions and oral

argument on the motions occurred on November 2, 2011. The parties are awaiting decision on the motions. The

court has scheduled a trial date of September 12, 2012. The trial date is subject to further delay based upon the

timing of any rulings on the outstanding motions by the parties and any objections or appeals of those decisions

along with other factors.

On February 7, 2011, MasterCard and MasterCard International Incorporated entered into each of: (1) an

omnibus judgment sharing and settlement sharing agreement with Visa Inc., Visa U.S.A. Inc. and Visa

International Service Association and a number of member banks; and (2) a MasterCard settlement and judgment

sharing agreement with a number of member banks. The agreements provide for the apportionment of certain

costs and liabilities which MasterCard, the Visa parties and the member banks may incur, jointly and/or

severally, in the event of an adverse judgment or settlement of one or all of the cases in the interchange merchant

litigations. Among a number of scenarios addressed by the agreements, in the event of a global settlement

involving the Visa parties, the member banks and MasterCard, MasterCard would pay 12% of the monetary

portion of the settlement. In the event of a settlement involving only MasterCard and the member banks with

respect to their issuance of MasterCard cards, MasterCard would pay 36% of the monetary portion of such

settlement.

MasterCard and the other defendants have been participating in separate court-recommended mediation

sessions with the individual merchant plaintiffs and the class plaintiffs. Based on progress to date in the

mediation, MasterCard recorded a $770 million pre-tax charge, or $495 million on an after-tax basis, in the

fourth quarter of 2011. This charge represents MasterCard’s estimate for the financial portion of a settlement in

these cases. The charge does not represent an estimate of a loss if the parties to the matter litigate, in which case

MasterCard cannot estimate the potential liability, if any. MasterCard’s estimate involves significant judgment

and may change depending on progress in settlement negotiations, or if the case is not settled, if the matter is

litigated.

127