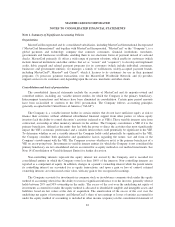

MasterCard 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

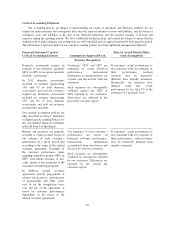

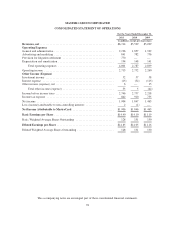

MASTERCARD INCORPORATED

CONSOLIDATED BALANCE SHEET

December 31,

2011 2010

(in millions, except share data)

ASSETS

Cash and cash equivalents ....................................................... $ 3,734 $ 3,067

Investment securities available-for-sale, at fair value .................................. 1,215 831

Investment securities held-to-maturity ............................................. — 300

Accounts receivable ........................................................... 808 650

Settlement due from customers ................................................... 601 497

Restricted security deposits held for customers ...................................... 636 493

Prepaid expenses and other current assets .......................................... 404 400

Deferred income taxes ......................................................... 343 216

Total Current Assets .......................................................... 7,741 6,454

Property, plant and equipment, at cost, net of accumulated depreciation ................... 449 439

Deferred income taxes ......................................................... 88 5

Goodwill .................................................................... 1,014 677

Other intangible assets, net of accumulated amortization ............................... 665 530

Auction rate securities available-for-sale, at fair value ................................. 70 106

Investment securities held-to-maturity ............................................. 36 36

Other assets .................................................................. 630 590

Total Assets ................................................................. $10,693 $ 8,837

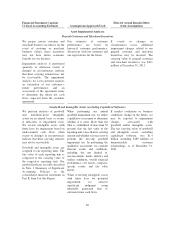

LIABILITIES AND EQUITY

Accounts payable ............................................................. $ 360 $ 272

Settlement due to customers ..................................................... 699 636

Restricted security deposits held for customers ...................................... 636 493

Obligations under litigation settlements ............................................ 4 298

Accrued litigation ............................................................. 770 —

Accrued expenses ............................................................. 1,610 1,315

Other current liabilities ......................................................... 138 129

Total Current Liabilities ...................................................... 4,217 3,143

Deferred income taxes ......................................................... 113 74

Other liabilities ............................................................... 486 404

Total Liabilities .............................................................. 4,816 3,621

Commitments and Contingencies

Stockholders’ Equity

Class A common stock, $0.0001 par value; authorized 3,000,000,000 shares, 132,771,392 and

129,436,818 shares issued and 121,618,059 and 122,696,228 outstanding, respectively .... — —

Class B common stock, $0.0001 par value; authorized 1,200,000,000 shares, 5,245,676 and

8,202,380 issued and outstanding, respectively .................................... — —

Additional paid-in-capital ....................................................... 3,519 3,445

Class A treasury stock, at cost, 11,153,333 and 6,740,590 shares, respectively ............. (2,394) (1,250)

Retained earnings ............................................................. 4,745 2,915

Accumulated other comprehensive (loss) income:

Cumulative foreign currency translation adjustments ............................. 30 105

Defined benefit pension and other postretirement plans, net of tax ................... (32) (12)

Investment securities available-for-sale, net of tax ................................ — 2

Total accumulated other comprehensive (loss) income ................................ (2) 95

Total Stockholders’ Equity .................................................... 5,868 5,205

Non-controlling interests ........................................................ 9 11

Total Equity ................................................................. 5,877 5,216

Total Liabilities and Equity .................................................... $10,693 $ 8,837

The accompanying notes are an integral part of these consolidated financial statements.

77