MasterCard 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

In July 2011, that settlement was finalized. MasterCard understands that the FCA intends to wait until the

judgment of the General Court of the European Union with respect to MasterCard’s appeal of the December 2007

cross-border interchange fee decision of the European Commission before deciding whether to re-engage

MasterCard as to its domestic interchange rates.

MasterCard is aware that regulatory authorities and/or central banks in certain other jurisdictions including

Austria, Belgium, Brazil, Colombia, Czech Republic, Estonia, Israel, Latvia, Lithuania, the Netherlands, Norway,

Russia, Slovakia, Turkey and Venezuela are reviewing MasterCard’s and/or its members’ interchange fees and/or

related practices (such as the “honor all cards” rule) and may seek to regulate the establishment of such fees and/

or such practices.

Other Regulatory Proceedings

In addition to challenges to interchange fees, MasterCard’s standards and operations are also subject to

regulatory and/or legal review and/or challenges in a number of jurisdictions. At this time, it is not possible to

determine the ultimate resolution of, or estimate the liability related to, any of the proceedings described below,

as the proceedings involve substantial uncertainties. Except as described below, no provision for losses has been

provided in connection with them. The proceedings as a whole reflect the increasing global regulatory focus to

which the payments industry is subject and, when taken as a whole, such regulatory decisions could result in the

imposition of costly new compliance burdens on MasterCard and its customers and may lead to increased costs

and decreased transaction volumes and revenues.

Switzerland. In July 2010, MasterCard received a notice from the Swiss Competition Authority (the

“WEKO”) that, based upon complaints, the WEKO had opened a pre-investigation of certain of MasterCard’s

domestic debit acquirer fees to determine whether to open a formal investigation with respect to these fees.

Despite the WEKO’s denial in September 2010 of immediate action and interim relief based on the complaints,

MasterCard understands that the WEKO has not closed its pre-investigation and is still considering whether to

open a formal investigation of the fees.

Ukraine. In June 2010, the Ukrainian Competition Authority (the “UCA”) issued MasterCard a

comprehensive information request concerning its rules and domestic fees in response to a complaint filed by a

Ukrainian banking association. In June 2011, MasterCard offered to reduce certain of its fees and the UCA

closed its investigation without making a formal decision.

Netherlands. On February 11, 2011, the Netherlands Competition Authority (the “NCA”) issued

MasterCard a Statement of Objections challenging MasterCard co-branding and co-residency rules and policies.

The co-branding rules being challenged prohibit, in some cases, financial institutions licensed by MasterCard

from placing other payment systems’ brands on MasterCard cards. The co-residency rules being challenged

prohibit, in some cases, licensed financial institutions from encoding other payment systems’ applications on the

electronic “chip” in MasterCard cards. MasterCard filed its response to the Statement of Objection on March 11,

2011. A hearing on the matter was held on April 14, 2011. In June 2011, the NCA informed MasterCard that it

has decided to take no action.

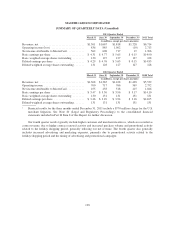

Note 21. Settlement and Other Risk Management

MasterCard’s rules generally guarantee the payment of certain MasterCard, Cirrus and Maestro branded

transactions between its customers. The term and amount of the guarantee are unlimited. Settlement risk is the

exposure to customers under MasterCard’s rules (“Settlement Exposure”), due to the difference in timing

133