MasterCard 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A world beyond cash: priceless

MasterCard Annual Report 2011

Table of contents

-

Page 1

A world beyond cash: priceless MasterCard Annual Report 2011 -

Page 2

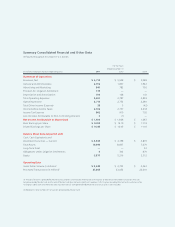

... Financial and Other Data All figures throughout this report in U.S. dollars For the Years Ended December 31 (in millions except per share and operating data) 2011 2010 2009 Statement of Operations Revenues, Net General and Administrative Advertising and Marketing Provision for Litigation... -

Page 3

... of the Board of Directors Dear Stockholders: On all fronts 2011 was a good year for MasterCard. We delivered strong financial results, including net revenue and earnings per share growth, as well as solid operational performance, with annual gross dollar volume, cross-border volume and processed... -

Page 4

..., data analytics and investments in security, are propelling us toward a world beyond cash. Our People and Social Responsibility In local markets around the world, our employees are on the ground applying their diverse insights and expertise to capture new opportunities while delivering value to... -

Page 5

...registrant is a shell company (as defined in Rule 12b-2 of the Act). The aggregate market value of the registrant's Class A common stock, par value $0.0001 per share, held by non-affiliates (using the New York Stock Exchange closing price as of June 30, 2011, the last business day of the registrant... -

Page 6

... and Issuer Purchases of Equity Securities ...Item 6. Selected Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...Item 7A. Quantitative and Qualitative Disclosures About Market Risk ...Item 8. Financial Statements and Supplementary Data... -

Page 7

...-border travel; the effect of general economic and global political conditions on consumer spending trends; exposure to loss or illiquidity due to guarantees of settlement and certain other third-party obligations; disruptions to our transaction processing systems and other services; account data... -

Page 8

... of well-known, widely-accepted payment brands, including MasterCard®, Maestro® and Cirrus®, which we license to our customers for use in their payment programs and solutions. We process payment transactions over the MasterCard Worldwide Network and provide support services to our customers and... -

Page 9

... orders, official checks, travelers cheques and other paper-based means of transferring value; Card-based payments-credit cards, charge cards, debit and deferred debit cards (including cash access or Automated Teller Machine ("ATM") cards), prepaid cards and other types of cards; Contactless, mobile... -

Page 10

... all customers through brand advertising, promotional and interactive programs and sponsorship initiatives. Transaction Processing on the MasterCard Worldwide Network Introduction. We operate the MasterCard Worldwide Network, our proprietary, global payments network that links issuers and acquirers... -

Page 11

... acquirer pays the amount of the purchase, net of a discount (referred to as the "merchant discount"), to the merchant. The merchant discount, among other things, takes into consideration the amount of the interchange fee. We generally guarantee the payment of transactions using MasterCard-branded... -

Page 12

... require value-added processing, such as real-time access to transaction data for fraud scoring or rewards at the point-of-sale, or customization of transaction data for unique consumer-spending controls, use the network's centralized processing structure, ensuring advanced processing services are... -

Page 13

... by MasterCard, and a settlement bank chosen by MasterCard. Customer settlement occurs in U.S. dollars or in a limited number of other currencies in accordance with our established rules. O O • Cross-Border and Domestic Processing. The MasterCard Worldwide Network provides our customers with... -

Page 14

...required services and the marketing strategy-in order to help ensure consistency in connection with these programs. Consumer Credit and Charge. MasterCard offers a number of consumer credit and charge programs that are designed to meet the needs of our customers. For the year ended December 31, 2011... -

Page 15

... Services. All MasterCard credit cards include services, such as lost/stolen card reporting, emergency card replacement and emergency cash advance, which are generally arranged by MasterCard and are provided through third-party service providers. • Debit. MasterCard supports a range of payment... -

Page 16

... services through Access Prepaid Worldwide ("Access"). Access was formed as a result of MasterCard acquiring the prepaid card program management operations of Travelex Holding Ltd. in April 2011. Through Access, MasterCard manages and delivers consumer and corporate prepaid travel cards to business... -

Page 17

... third-party digital wallets are embedded with MasterCard payment functionality. Mobile Money Services: MasterCard provides various services to customers to enable consumers to pay from any type of mobile phone. These services include linking mobile accounts to virtual MasterCard account numbers to... -

Page 18

... of advanced authorization, transaction routing and alert controls and virtual card number capabilities that uses the functionality of the MasterCard Worldwide Network and is designed to assist financial institutions in creating new and enhanced payment offerings. MasterCard offers several fraud... -

Page 19

... Moreover, we work with merchants to provide employees the option of being paid on MasterCard payroll cards, and to enable merchants the ability to collect payments using MasterCard payment solutions. We also offer a suite of information products, data analytics and marketing services which can help... -

Page 20

... of advancing commerce globally. Our marketing activities combine advertising, sponsorships, promotions, digital, mobile and social media, public relations and issuer and merchant engagement as part of an integrated program designed to increase consumer preference for MasterCard brands and usage of... -

Page 21

...-based or PIN-based Tiered pricing, with rates decreasing as customers meet incremental volume/transaction hurdles Geographic region or country Retail purchase or cash withdrawal Processed or not processed by MasterCard In general, cross-border transactions generate higher revenue than domestic... -

Page 22

... provides information regarding the GDV for all MasterCard-branded cards (excluding Cirrus and Maestro) and for both MasterCard credit and charge programs and MasterCard debit and prepaid programs in the United States and in all of our other regions for the years ended December 31, 2011 and 2010... -

Page 23

... Maestro and Cirrus-branded transactions, which is primarily estimated using the average daily card volume during the quarter multiplied by the estimated number of days to settle, was approximately $39.1 billion as of December 31, 2011. Principal customers participate directly in MasterCard programs... -

Page 24

...prevent fraud, including MasterCard SecureCode®, a global Internet authentication solution that permits cardholders to authenticate themselves to their issuer using a unique, personal code, and our Site Data Protection program to advance adherence to the PCI DSS. We also provide fraud detection and... -

Page 25

... General. MasterCard programs compete against all forms of payment, including paper-based transactions (principally cash and checks); card-based payment systems, including credit, charge, debit, prepaid, private-label and other types of general purpose and limited use cards; contactless, mobile... -

Page 26

...merchants and direct issuing relationships with cardholders, such as American Express and Discover. These competitors have certain advantages that we do not enjoy. Among other things, these competitors do not require formal interchange fees to balance payment system costs among issuers and acquirers... -

Page 27

... of new online competitors. Among other services, these competitors provide Internet payment services that can be used to buy and sell goods online, and services that support payments to and from deposit accounts or proprietary accounts for Internet, mobile commerce and other applications. A number... -

Page 28

... to surcharge. Our no-surcharge rules in Canada have also been challenged by the Canadian Competition Bureau. Data Protection and Information Security. Aspects of our operations or business are subject to privacy and data protection regulation in the United States, the European Union and elsewhere... -

Page 29

...' technology service providers. Examinations by the FFIEC cover areas such as data integrity and data security. In recent years, the U.S. federal banking regulators have adopted a series of regulatory measures affecting credit card payment terms and requiring more conservative accounting, greater... -

Page 30

... the use of payment cards, which could decrease our transaction volumes. In some circumstances, new regulations could have the effect of limiting our customers' ability to offer new types of payment programs or restricting their ability to offer our existing programs such as prepaid cards, which... -

Page 31

... stock) and Class B common stock (our non-voting stock), see Note 15 (Stockholders' Equity) to the consolidated financial statements included in Part II, Item 8 of this Report. Website and SEC Reports The Company's internet address is www.mastercard.com. From time to time, we may use our website... -

Page 32

... electronic payments (including MasterCard) to negotiate lower merchant discount rates and interchange fees with merchants. In Nigeria, in August 2011, the Central Bank of Nigeria announced new guidelines related to point of sale card acceptance services, prescribing certain minimum standards and... -

Page 33

..., Visa and a number of large Canadian banks relating to MasterCard and Visa rules related to interchange fees, including "honor all cards" and "no surcharge" rules. See Note 20 (Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8 for more details... -

Page 34

...Street Reform and Consumer Protection Act (with certain exceptions for issuer compliance with the exclusivity requirements). The regulations limit per-transaction U.S. debit and prepaid interchange fees to 21 cents plus five basis points. The issuer may receive interim fraud prevention adjustment of... -

Page 35

... in our payments volume and revenues. If issuers, acquirers and/or merchants modify their business operations or otherwise take actions in response to this legislation which have the result of reducing the number of debit or prepaid transactions we process or the network fees we collect, the... -

Page 36

... affecting the pricing, credit allocation, and business models of most major credit card issuers. Additional regulations include regulations by the Board of Governors regulating overdraft fees imposed in connection with ATM and debit card transactions. Regulation of Internet Transactions-Regulation... -

Page 37

... on our business in recent years because of litigation. For example, as a result of the settlement agreement in connection with the U.S. merchant lawsuit in 2003, merchants have the right to reject our debit cards in the United States while still accepting other MasterCard-branded cards, and vice... -

Page 38

... American Express, Discover, private-label card networks and certain alternative payments systems, operate end-to-end payment systems with direct connections to both merchants and consumers, without involving intermediaries. These competitors seek to derive competitive advantages from their business... -

Page 39

... the prices we charge our customers, which may materially and adversely affect our business, revenue and profitability. We generate revenue from the fees that we charge our customers for providing transaction processing and other payment-related services and from assessments on the dollar volume of... -

Page 40

...accept our cards for payment, our business may be materially and adversely affected. We are, and will continue to be, significantly dependent on our relationships with our issuers and acquirers and their further relationships with cardholders and merchants to support our programs and services. We do... -

Page 41

... to cross-border) transactions conducted using MasterCard, Maestro and Cirrus cards are authorized, cleared and settled by our customers or other processors. Because we do not provide domestic processing services in these countries and do not, as described above, have direct relationships with... -

Page 42

... spending for value-added services. Government intervention, including the effect of laws, regulations and/or government investments in our customers, may have potential negative effects on our business and our relationships with customers or otherwise alter their strategic direction away from... -

Page 43

... transactions using MasterCard, Maestro and Cirrus-branded cards and generate a significant amount of revenue from cross-border volume fees and transaction processing fees. Revenue from processing cross-border and currency conversion transactions for our customers fluctuates with cross-border travel... -

Page 44

..., our customers, merchants, and other third parties process, transmit or store cardholder account and other information in connection with payment cards. In addition, our customers may sponsor third-party processors to process transactions generated by cards carrying our brands and merchants may use... -

Page 45

...to claims against us. In recent years, there have been several high-profile account data compromise events involving merchants and third-party payment processors that process, store or transmit payment card data, which affected millions of MasterCard, Visa, Discover, American Express and other types... -

Page 46

..., we cannot guarantee that we will be able to execute and integrate any such acquisitions. Risks Related to our Class A Common Stock and Governance Structure Future sales of our shares of Class A common stock could depress the market price of our Class A common stock. The market price of our... -

Page 47

...of MasterCard, or any operator, customer or licensee of any competing general purpose payment card system, or any affiliate of any such person, may beneficially own any share of Class A common stock or any other class or series of our stock entitled to vote generally in the election of directors. In... -

Page 48

... stock and Class B common stock. Item 1B. Unresolved Staff Comments Not applicable. Item 2. Properties As of December 31, 2011, MasterCard and its subsidiaries owned or leased 114 commercial properties. We own our corporate headquarters, a 472,600 square foot building located in Purchase, New York... -

Page 49

Item 3. Legal Proceedings Refer to Notes 18 (Obligations Under Litigation Settlements) and 20 (Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8. Item 4. Mine Safety Disclosures Not applicable 45 -

Page 50

... public trading market for our Class B common stock. There were approximately 483 holders of record of our Class B common stock as of February 9, 2012. Dividend Declaration and Policy During the years ended December 31, 2011 and 2010, we paid the following quarterly cash dividends per share... -

Page 51

... Purchases of Equity Securities In September 2010, the Company's Board of Directors authorized a plan for the Company to repurchase up to $1 billion of its Class A common stock in open market transactions. In April 2011, the Company's Board of Directors amended the existing share repurchase program... -

Page 52

... in Part II, Item 8 of this Report. 2011 Years Ended December 31, 2010 2009 2008 (in millions, except per share data) 2007 Statement of Operations Data: Revenues, net ...Total operating expenses ...Operating income (loss) ...Net income (loss) attributable to MasterCard ...Basic earnings (loss... -

Page 53

.... Our customers and partners include financial institutions and other entities that act as "issuers" and "acquirers", merchants, government entities, telecommunications companies and other businesses. We manage a family of well-known, widely-accepted payment brands, including MasterCard, Maestro and... -

Page 54

... over the MasterCard Worldwide Network and provide support services to our customers and other partners. As part of managing our brands, we establish and enforce a common set of standards for adherence by our customers for the efficient and secure use of our payments network. We generate revenues... -

Page 55

..., issuer processing and program management services, primarily focused on the travel sector and in markets outside the United States. On October 22, 2010 MasterCard acquired all the outstanding shares of DataCash Group plc ("DataCash"), a payment service provider with operations in Europe and... -

Page 56

...period, but differences in market growth, economic health, and foreign exchange fluctuations in certain countries have increased the proportion of revenues generated outside the United States over time. While the global nature of our business helps protect our operating results from adverse economic... -

Page 57

... 31, 2011, 2010 and 2009 were as follows: For the Years Ended December 31, Percent Increase (Decrease) 2011 2010 2009 2011 2010 (in millions, except per share data, percentages and GDV amounts) Revenues, net ...Operating Expenses: General and administrative ...Advertising and marketing ...Provision... -

Page 58

... addition, changes in foreign currency exchange rates directly impact the calculation of gross dollar volume ("GDV") and gross euro volume ("GEV"), which are used in the calculation of our domestic assessments, cross-border volume fees and volume related rebates and incentives. In most non-European... -

Page 59

... merchant relationships and promoting acceptance at the point of sale. Market development fees are charged primarily to issuers and acquirers based on components of volume, and support our focus on building brand awareness and card activation, increasing purchase volumes, cross-border card usage... -

Page 60

... listing to merchants. Cardholder services fees are for benefits provided with MasterCard-branded cards, such as insurance, telecommunications assistance for lost cards and locating automated teller machines. Consulting and research fees are primarily generated by MasterCard Advisors, the Company... -

Page 61

... face increasingly intense competitive pressure on the prices we charge our customers, which may materially and adversely affect our revenue and profitability" in Part I, Item 1A of this Report. The significant components of our net revenues for the years ended December 31, 2011, 2010 and 2009 were... -

Page 62

... point negative impact on 2010 cross-border revenue growth. The net impact of foreign currency relating to the translation of cross-border volume fees from our functional currencies to U.S. dollars favorably impacted cross-border volume fees revenue growth by approximately 1 percentage point in 2011... -

Page 63

... In 2011 and 2010, higher rebates and incentives were driven by increased performance as well as certain new and renewed agreements. The Company intends to continue to enter into and maintain business agreements that provide rebates and incentives to certain customers and merchants. Pricing changes... -

Page 64

... ended December 31, 2011, 2010 and 2009 were as follows: Percent For the Years Ended December 31, Increase (Decrease) 2011 2010 2009 2011 2010 (in millions, except percentages) Personnel ...Professional fees ...Telecommunications ...Data processing ...Travel and entertainment ...Other ...General... -

Page 65

... Telecommunications and data processing expense consist of expenses to support our global payments network infrastructure, expenses to operate and maintain our computer systems and other telecommunication needs. These expenses vary with business volume growth, system upgrades and usage. Travel and... -

Page 66

... earnout related to the Company's recent acquisition of Access (see Note 2 (Acquisitions) to the consolidated financial statements included in Part II, Item 8 of this Report), partially offset by expenses from equity method investments. The increase of total other income in 2010 versus 2009 of $47... -

Page 67

...and current available-for-sale securities to use for our operations. In September 2010, the Company's Board of Directors authorized a plan for the Company to repurchase up to $1 billion of its Class A common stock in open market transactions. The Company did not repurchase any shares under this plan... -

Page 68

... security activities. Net cash used in financing activities for the year ended December 31, 2011 primarily related to the repurchase of the Company's Class A common stock and dividend payments to our stockholders. Net cash provided by financing activities for the year ended December 31, 2010... -

Page 69

... of customers of MasterCard. On November 4, 2009, the Company filed a universal shelf registration statement to provide additional access to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time offer to sell debt securities, preferred stock or Class... -

Page 70

...accordance with merchant agreements for future marketing, computer hardware maintenance, software licenses and other service agreements. Future cash payments that will become due to our customers under agreements which provide pricing rebates on our standard fees and other incentives in exchange for... -

Page 71

... domestic assessments and total net revenues in both 2010 and 2009. Our revenue recognition policies are fully described in Note 1 (Summary of Significant Accounting Policies) to the consolidated financial statements in Part II, Item 8 of this Report. Rebates and incentives are generally recorded... -

Page 72

...) to the consolidated financial statements in Part II, Item 8 of this Report, MasterCard does not believe that any legal or regulatory proceedings to which it is a party would have a material adverse impact on its business or prospects. Assumptions/Approach Used Legal and Regulatory Matters We... -

Page 73

... The carrying value of prepaid customer and merchant incentives was $471 million at December 31, 2011. Goodwill and Intangible Assets (excluding Capitalized Software) We perform analyses of goodwill When performing our annual If market conditions or business and indefinite-lived intangible goodwill... -

Page 74

...appropriateness of that indefinite life annually. Recent Accounting Pronouncements Assumptions/Approach Used We use internal data and estimates regarding changes in our customer relationships and future cash flows to assess the indefinite life and assess fair value. Effect if Actual Results Differ... -

Page 75

... receivables in the disclosures to financial statements including, but not limited to, significant purchases and sales of financing receivables, aging information and credit quality indicators. The Company adopted this accounting standard effective January 1, 2011, and the adoption did not have... -

Page 76

... of the Company's available for sale investments as of December 31 was as follows: (in millions) Fair Market Value at December 31, 2011 2012 Maturity (in millions) 2017 and 2016 there-after Financial Instrument Summary Terms 2013 2014 2015 Municipal securities ...Corporate securities... -

Page 77

... Summary Terms (in millions) Fair Market Value at December 31, 2010 2011 Maturity (in millions) 2016 and 2015 there-after 2012 2013 2014 Municipal securities ...Fixed Interest Short-term bond funds ...Fixed /Variable Interest1 Auction rate securities ...Variable Interest Total ...1 $315 5161... -

Page 78

..., 2011 and 2010 and for the years ended December 31, 2011, 2010 and 2009 Management's Report on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheet ...Consolidated Statement of Operations ...Consolidated Statement of Cash... -

Page 79

...generally accepted in the United States of America. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. As required by Section 404 of the Sarbanes-Oxley Act of 2002, management has assessed the effectiveness of MasterCard's internal... -

Page 80

... Reporting. Our responsibility is to express opinions on these financial statements, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United... -

Page 81

MASTERCARD INCORPORATED CONSOLIDATED BALANCE SHEET December 31, 2011 2010 (in millions, except share data) ASSETS Cash and cash equivalents ...Investment securities available-for-sale, at fair value ...Investment securities held-to-maturity ...Accounts receivable ...Settlement due from customers ... -

Page 82

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF OPERATIONS For the Years Ended December 31, 2011 2010 2009 (in millions, except per share data) Revenues, net ...Operating Expenses General and administrative ...Advertising and marketing ...Provision for litigation settlement ...Depreciation and ... -

Page 83

... CONSOLIDATED STATEMENT OF CASH FLOWS For the Years Ended December 31, 2011 2010 2009 (in millions) Operating Activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...Share based payments ...Stock units withheld... -

Page 84

... CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Accumulated Retained Other Earnings Comprehensive Common Stock Additional Class A Non(Accumulated (Loss) Income, Net Paid-In Treasury Controlling Deficit) of Tax Class A Class B Capital Stock Interests Total (in millions, except per share data) Balance at... -

Page 85

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the Years Ended December 31, 2011 2010 2009 (in millions) Net Income ...Other comprehensive (loss) income: Foreign currency translation adjustments ...Defined benefit pension and postretirement plans ...Income tax effect ...... -

Page 86

... brands, including MasterCard®, Maestro® and Cirrus®, which it licenses to its customers for use in their payment programs; (3) processes payment transactions over the MasterCard Worldwide Network; and (4) provides support services to its customers and, depending upon the service, merchants... -

Page 87

...on management's judgment using internal and external data, these fair value determinations are classified in Level 3 of the Valuation Hierarchy. See Note 5 (Fair Value) for information about methods and assumptions. The Company has not elected to apply the fair value option to its eligible financial... -

Page 88

...-sale equity securities are recognized in investment income on the consolidated statement of operations. The specific identification method is used to determine realized gains and losses. Settlement due from/due to customers-The Company operates systems for clearing and settling payment transactions... -

Page 89

... enters into operating and capital leases for the use of premises, software and equipment. Rent expense related to lease agreements which contain lease incentives is recorded on a straight-line basis. Business combinations-The Company accounts for businesses acquired in business combinations under... -

Page 90

... policies and procedures, which include risk standards to provide a framework for managing the Company's settlement exposure. Settlement risk is the legal exposure due to the difference in timing between the payment transaction date and subsequent settlement. MasterCard's rules generally guarantee... -

Page 91

...date of its year-end balance sheet. Share based payments-The Company recognizes the fair value of all share-based payments to employees in its financial statements. The Company uses the straight-line method of attribution for expensing equity awards. Compensation expense is recorded net of estimated... -

Page 92

... average exchange rate for the period. Resulting translation adjustments are reported as a component of other comprehensive income (loss). Earnings per share-The Company calculates earnings per share using the two-class method. The two-class method clarifies that unvested share-based payment awards... -

Page 93

... of Financing Receivables and the Allowance for Credit Losses-In July 2010, a new accounting standard was issued that requires companies to provide more information about the credit quality of their financing receivables in the disclosures to financial statements including, but not limited to, 89 -

Page 94

... into an agreement to acquire the prepaid card program management operations of Travelex Holdings Ltd., since renamed Access Prepaid Worldwide ("Access"). Pursuant to the terms of the acquisition agreement, the Company acquired Access on April 15, 2011, at a purchase price of 295 million U.K. pound... -

Page 95

... of Access enables the Company to offer end-to-end prepaid card solutions encompassing branded switching, issuer processing, and program management services, primarily focused on the travel sector and in markets outside the United States. The following table summarizes the purchase price allocation... -

Page 96

... 22, 2010, the acquisition date. The excess of purchase consideration over net assets acquired was recorded as goodwill. The Company expects value from expanding the Company's e-Commerce payment and related electronic payments solutions, fraud prevention, alternative payment options, back-office... -

Page 97

... common shares under the two-class method for each of the years ended December 31 were as follows: 2011 2010 2009 (in millions, except per share data) Numerator: Net income attributable to MasterCard ...Less: Net income allocated to Unvested Units ...Net income attributable to MasterCard allocated... -

Page 98

... flow disclosures for each of the years ended December 31: 2011 2010 2009 (in millions) Cash paid for income taxes ...Cash paid for interest ...Cash paid for legal settlements (Notes 18 and 20) ...Non-cash investing and financing activities: Dividends declared but not yet paid ...Municipal bonds... -

Page 99

...The fair value of the Company's available-for-sale municipal securities, U.S. Government and Agency securities, corporate securities, asset-backed securities and other fixed income securities are based on quoted prices for similar assets in active markets and are therefore included in Level 2 of the... -

Page 100

... from customers, restricted security deposits held for customers, prepaid expenses, accounts payable, settlement due to customers and accrued expenses. Investment Securities Held-to-Maturity The Company utilizes quoted prices for similar securities from active markets to estimate the fair value of... -

Page 101

...using internal and external data, these fair value determinations are classified in Level 3 of the Valuation Hierarchy. Note 6. Investment Securities Amortized Costs and Fair Values-Available-for-Sale Investment Securities: The major classes of the Company's available-for-sale investment securities... -

Page 102

...of the Company's ARS investments from January 1, 2010 to December 31, 2011. Significant Unobservable Inputs (Level 3) (in millions) Fair value, December 31, 2009 ...Calls, at par ...Recovery of unrealized losses due to issuer calls ...Increase in fair value ...Fair value, December 31, 2010 ...Calls... -

Page 103

... in the discount rate used in the discounted cash flow analysis would have increased the impairment by $3 million and $2 million at December 31, 2011 and 2010, respectively. Carrying and Fair Values-Held-to-Maturity Investment Securities: As of December 31, 2011, the Company owned a held-to-maturity... -

Page 104

... generated from cash, cash equivalents, investment securities available-for-sale and investment securities held-to-maturity. Note 7. Prepaid Expenses and Other Assets Prepaid expenses and other current assets consisted of the following at December 31: 2011 2010 (in millions) Customer and merchant... -

Page 105

... investee, generally when it holds 20% or more of the common stock in the entity. MasterCard's share of net earnings or losses of entities accounted for under the equity method of accounting is included in other income (expense) on the consolidated statement of operations. The Company accounts for... -

Page 106

... for the years ended December 31, 2011 and 2010 were as follows: 2011 2010 (in millions) Beginning balance ...Goodwill acquired during the year ...Foreign currency translation ...Ending balance ... $ 677 354 (17) $1,014 $309 402 (34) $677 On April 15, 2011, MasterCard acquired Access. The Company... -

Page 107

... and the acquisition of Access. Additions to capitalized software in 2010 primarily related to internally developed software and the acquisition of DataCash. See Note 2 (Acquisitions) for further details. Amortizable customer relationships were added in 2011 and 2010 due to the acquisitions of... -

Page 108

... years ending December 31: (in millions) 2012 ...2013 ...2014 ...2015 ...2016 and thereafter ... $131 108 82 53 102 $476 Note 11. Accrued Expenses Accrued expenses consisted of the following at December 31: 2011 2010 (in millions) Customer and merchant incentives ...Personnel costs ...Advertising... -

Page 109

... balance sheet consist of: Prepaid expenses, long term ...Accrued expenses ...Other liabilities, long term ...Amounts recognized in accumulated other comprehensive income consist of: Net actuarial loss (gain) ...Prior service credit ...Weighted-average assumptions used to determine end of year... -

Page 110

...% 2016 2016 Components of net periodic benefit cost recorded in general and administrative expenses were as follows for the Plans for each of the years ended December 31: 2011 Pension Plans Postretirement Plan 2010 2009 2011 2010 2009 (in millions) Service cost ...Interest cost ...Expected return... -

Page 111

...Prior service credit ...Total ... $4 (2) $2 $- - $- Weighted-average assumptions used to determine net periodic benefit cost were as follows for the years ended December 31: 2011 Pension Plans 2010 2009 Postretirement Plan 2011 2010 2009 Discount rate ...Expected return on plan assets ...Rate of... -

Page 112

...the Company's financial instruments. See Note 1 (Summary of Significant Accounting Policies). Mutual funds (including small cap U.S. equity securities and non-U.S. equity securities) are public investment vehicles valued at quoted market prices, which represent the net asset value of the shares held... -

Page 113

... FINANCIAL STATEMENTS-(Continued) December 31, 2010 Significant Other Significant Observable Unobservable Inputs Inputs (Level 2) (Level 3) (in millions) Quoted Prices in Active Markets (Level 1) Fair Value Mutual funds: Money market ...Domestic small cap equity ...International equity ...Common... -

Page 114

... Credit Facility are available to provide liquidity for general corporate purposes, including providing liquidity in the event of one or more settlement failures by the Company's customers. In addition, for business continuity planning and related purposes, the Company may borrow and repay amounts... -

Page 115

... equity method of accounting and recorded in other assets on the consolidated balance sheet. Note 15. Stockholders' Equity Classes of Capital Stock MasterCard's amended and restated certificate of incorporation authorizes the following classes of capital stock: Par Value Per Share Authorized Shares... -

Page 116

.... In February 2010, the Company's Board of Directors authorized programs to facilitate conversions of shares of Class B common stock (without limits as to the number of shares) on a one-for-one basis into shares of Class A common stock for subsequent sale or transfer to public investors, beginning... -

Page 117

... billion of its Class A common stock in open market transactions. The Company did not repurchase any shares under this plan during the year ended December 31, 2010. In April 2011, the Company's Board of Directors amended the existing share repurchase program, authorizing the Company to repurchase an... -

Page 118

...date of grant using a Black-Scholes option pricing model. The following table presents the weighted-average assumptions used in the valuation and the resulting weightedaverage fair value per option granted for the years ended December 31: 2011 2010 2009 Risk-free rate of return ...Expected term (in... -

Page 119

... earned their awards. The fair value of each RSU is the closing stock price on the New York Stock Exchange of the Company's Class A common stock on the date of grant. The weighted-average grant-date fair value of RSUs granted during the years ended December 31, 2011, 2010 and 2009 was $257, $231... -

Page 120

... the ultimate number of shares to be issued is determined. Estimates are adjusted as appropriate. Compensation expense is calculated using the number of PSUs expected to vest, multiplied by the period ending price of a share of MasterCard's Class A common stock on the New York Stock Exchange, less... -

Page 121

... The Director Plan provides for awards of Deferred Stock Units ("DSUs") to each director of the Company who is not a current employee of the Company. There are 100 thousand shares of Class A common stock reserved for DSU awards under the Director Plan. During the years ended December 31, 2011, 2010... -

Page 122

...million for the years ended December 31, 2011, 2010 and 2009, respectively. In January 2003, MasterCard purchased a building in Kansas City, Missouri for approximately $24 million. The building is a co-processing data center which replaced a back-up data center in Lake Success, New York. During 2003... -

Page 123

... present value of $1.8 billion, at a 5.75% discount rate, or $1.6 billion in the quarter ended June 30, 2008. During the three months ended June 30, 2011, the Company made its final quarterly payment of $150 million. In 2003, MasterCard entered into a settlement agreement (the "U.S. Merchant Lawsuit... -

Page 124

... of the Singapore Economic Development Board. The incentive had provided MAPPL with, among other benefits, a reduced income tax rate for the 10-year period commencing January 1, 2010 on taxable income in excess of a base amount. The Company continued to explore business opportunities in this region... -

Page 125

... to utilize net operating losses following a change in control. A reconciliation of the beginning and ending balance for the Company's unrecognized tax benefits for the years ended December 31, is as follows: 2011 2010 2009 (in millions) Beginning balance ...Additions: Current year tax positions... -

Page 126

... on the Board of Directors of MasterCard or Visa while a portion of its card portfolio is issued under the brand of the other association-was anti-competitive and acted to limit innovation within the payment card industry. Second, the DOJ challenged MasterCard's Competitive Programs Policy ("CPP... -

Page 127

... ordered MasterCard to repeal the CPP insofar as it applies to issuers and enjoined MasterCard from enacting or enforcing any bylaw, rule, policy or practice that prohibits its issuers from issuing general purpose credit or debit cards in the United States on any other general purpose card network... -

Page 128

... number of U.S. merchants against MasterCard International and Visa U.S.A., Inc. challenging certain aspects of the payment card industry under U.S. federal antitrust law. Those suits were later consolidated in the U.S. District Court for the Eastern District of New York. The plaintiffs claimed that... -

Page 129

... action complaint in the U.S. District Court for the District of Columbia against both MasterCard and Visa. Plaintiffs seek to represent a class of non-bank operators of ATM terminals that operate ATM terminals in the United States with the discretion to determine the price of the ATM access fee for... -

Page 130

... amended class action complaint described above although plaintiffs have added additional claims brought under Sections 1 and 2 of the Sherman Act against MasterCard, Visa and a number of banks alleging, among other things, that the networks and banks have continued to fix interchange fees following... -

Page 131

...and Visa International Service Association and a number of member banks; and (2) a MasterCard settlement and judgment sharing agreement with a number of member banks. The agreements provide for the apportionment of certain costs and liabilities which MasterCard, the Visa parties and the member banks... -

Page 132

... default cross-border interchange fees for MasterCard and Maestro branded consumer payment card transactions in the European Economic Area ("EEA") (the European Commission refers to these as "MasterCard's MIF"), but not to commercial card transactions (the European Commission stated publicly that it... -

Page 133

... service fee ("MSF"), the fee paid by issuers to acquirers when a customer uses a MasterCardbranded card in the United Kingdom either at an ATM or over the counter to obtain a cash advance. Until November 2004, the interchange fees and MSF were established by MasterCard U.K. Members Forum Limited... -

Page 134

... and MasterCard's overall business in the U.K. Poland. In April 2001, in response to merchant complaints, the Polish Office for Protection of Competition and Consumers (the "PCA") initiated an investigation of MasterCard's domestic credit and debit card default interchange fees. MasterCard Europe... -

Page 135

... Italian customers and on MasterCard's overall business in Italy. Canada. In December 2010, the Canadian Competition Bureau (the "CCB") filed an application with the Canadian Competition Tribunal to strike down certain MasterCard rules related to interchange fees, including the "honor all cards" and... -

Page 136

... credit card payment systems in Australia, including MasterCard's. Those regulations, among other things, mandate the use of a formula for determining domestic interchange fees that effectively caps their weighted average at 50 basis points. Operators of three-party systems, such as American Express... -

Page 137

.... In June 2010, the Ukrainian Competition Authority (the "UCA") issued MasterCard a comprehensive information request concerning its rules and domestic fees in response to a complaint filed by a Ukrainian banking association. In June 2011, MasterCard offered to reduce certain of its fees and the UCA... -

Page 138

... estimated using the average daily card volume during the quarter multiplied by the estimated number of days to settle. The Company has global risk management policies and procedures, which include risk standards, to provide a framework for managing the Company's settlement risk. Customer-reported... -

Page 139

... 2011 or 2010. Of the total uncollateralized Settlement Exposure attributable to non-compliant customers, five customers represented approximately 73% and 64% at December 31, 2011 and 2010, respectively. MasterCard guarantees the payment of MasterCard-branded travelers cheques in the event of issuer... -

Page 140

... represent gross fair value amounts while these amounts may be netted for actual balance sheet presentation. Amount and Location of Gain (Loss) Recognized in Income Year Ended December 31, 2011 2010 2009 (in millions) Foreign Currency Derivative Contracts1 General and administrative ...Revenues... -

Page 141

... by geographic market is based on the location of the Company's customer that issued the card, as well as the location of the merchant acquirer where the card is being used. Revenue generated in the U.S. was approximately 39.6%, 41.6%, and 42.4% of net revenues in 2011, 2010 and 2009, respectively... -

Page 142

... financial statements included in Part II, Item 8 of this Report for further discussion. Our fourth quarter results typically include higher customer and merchant incentives, which are recorded as contra-revenue, due to higher contract renewal activity and increased purchase volume and promotional... -

Page 143

... under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this Report. Any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. Based on that evaluation, the Company... -

Page 144

... Item with respect to security ownership of certain beneficial owners and management equity and compensation plans will appear in the Proxy Statement and is incorporated by reference into this Report. Item 13. Certain Relationships and Related Transactions, and Director Independence The information... -

Page 145

... of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. MASTERCARD INCORPORATED (Registrant) Date: February 16, 2012 By: /S/ AJAY BANGA Ajay Banga... -

Page 146

... OLIVIÉ Marc Olivié Director Date: February 16, 2012 By: /s/ RIMA QURESHI Rima Qureshi Director Date: February 16, 2012 By: /s/ JOSÉ OCTAVIO REYES LAGUNES José Octavio Reyes Lagunes Director Date: February 16, 2012 By: Date: February 16, 2012 By: Date: February 16, 2012 By: /s/ EDWARD SUNING... -

Page 147

... to the Kansas City facility (incorporated by reference to Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q filed August 8, 2003 (File No. 000-50250)). Employment Agreement between MasterCard International Incorporated and Ajay Banga, dated as of July 1, 2010 (incorporated by reference to... -

Page 148

...to the Company's Quarterly Report on Form 10-Q filed November 2, 2010 (File No. 001-32877)). MasterCard International Incorporated Restoration Program, as amended and restated January 1, 2007 unless otherwise provided (incorporated by reference to Exhibit 10.22 to the Company's Annual Report on Form... -

Page 149

... Visa U.S.A. Inc. and Visa International Service Association (incorporated by reference to Exhibit 10.3 to the Company's Quarterly Report on Form 10-Q filed August 1, 2008. (File No. 001-32877)). Release and Settlement Agreement dated as of October 27, 2008 by and among MasterCard, Discover and Visa... -

Page 150

... Inc., Visa U.S.A. Inc., Visa International Service Association and MasterCard's customer banks that are parties thereto (incorporated by reference to Exhibit 10.33 to Amendment No.1 to the Company's Annual Report on Form 10-K/A filed on November 23, 2011). MasterCard Settlement and Judgment Sharing... -

Page 151

... that has been filed separately with the U.S. Securities and Exchange Commission and has been granted confidential treatment. The agreements and other documents filed as exhibits to this report are not intended to provide factual information or other disclosure other than with respect to the... -

Page 152

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 153

... Group President, International Markets Gary J. Flood President, Global Products and Solutions David R. Carlucci 1 (Chair) Former Chairman and Chief Executive Offi cer IMS Health Incorporated Noah J. Hanft General Counsel, Corporate Secretary and Chief Franchise Integrity Offi cer Steven... -

Page 154

...com, for updated news releases, stock performance, financial reports, recent investments, investment community presentations, corporate governance and other investor information. Stock Listing and Symbol New York Stock Exchange Symbol: MA Contact the MasterCard Board of Directors To communicate with... -

Page 155

...and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2011 (which is included in this annual report), Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that it has filed with the SEC in 2012. MasterCard's forward-looking statements speak... -

Page 156

www.mastercard.com © 2012 MasterCard