Kraft 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

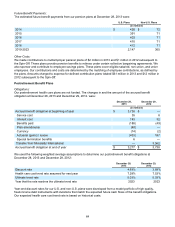

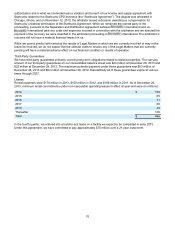

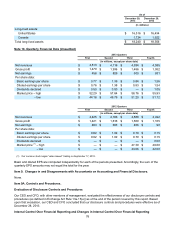

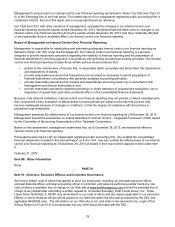

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the

following at December 28, 2013 and December 29, 2012:

December 28,

2013 December 29,

2012

(in millions)

Deferred income tax assets:

Pension benefits $ 104 $ 730

Postretirement benefits 1,238 1,418

Other employee benefits 122 102

Other 497 442

Total deferred income tax assets 1,961 2,692

Valuation allowance (3) (26)

Net deferred income tax assets $ 1,958 $ 2,666

Deferred income tax liabilities:

Trade names $ (828) $ (827)

Property, plant and equipment (949) (969)

Debt exchange (384) (418)

Other (65) (17)

Total deferred income tax liabilities (2,226) (2,231)

Net deferred income tax assets / (liabilities) $ (268) $ 435

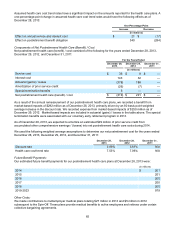

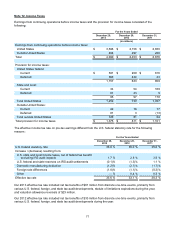

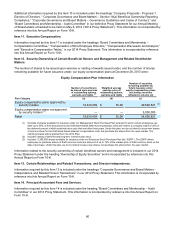

Note 13. Accumulated Other Comprehensive Earnings / (Losses)

Total accumulated other comprehensive earnings / (losses) consists of net earnings / (losses) and other changes in

business equity from transactions and other events from sources other than shareholders. It includes foreign

currency translation gains and losses, defined postemployment benefit plan adjustments, and unrealized gains and

losses from derivative instruments designated as cash flow hedges.

The components of, and changes in, accumulated other comprehensive earnings / (losses) were as follows (net of

tax):

Foreign

Currency

Adjustments

Postemployment

Benefit Plan

Adjustments

Derivative

Hedging

Adjustments

Total

Accumulated Other

Comprehensive

Earnings / (Losses)

(in millions)

Balance at December 30, 2012 $ (359) $ 51 $ (152) $ (460)

Other comprehensive (losses) / gains

before reclassifications:

Foreign currency adjustments (68) — — (68)

Unrealized gains in fair value — — 20 20

Prior service credits — 19 — 19

(68) 19 20 (29)

Amounts reclassified from

accumulated other comprehensive

earnings:

Transfer of realized losses in fair

value to net earnings — — 3 3

Amortization of prior service

credits — (13) — (13)

— (13) 3 (10)

Net current-period other

comprehensive (losses) / earnings (68) 6 23 (39)

Balances at December 28, 2013 $ (427) $ 57 $ (129) $ (499)