Kraft 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

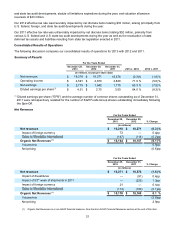

Items Affecting Comparability of Financial Results

Principles of Consolidation

Prior to the Spin-Off on October 1, 2012, our financial statements were prepared on a stand-alone basis and were

derived from the consolidated financial statements and accounting records of International. Our financial

statements for the years ended December 29, 2012 and December 31, 2011, included certain expenses of

International that were allocated to us. These allocations were not necessarily indicative of the actual

expenses we would have incurred as an independent public company or of the costs we will incur in the future, and

may differ substantially from the allocations we agreed to in the various separation agreements.

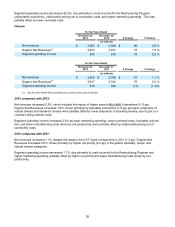

Cost Savings Initiatives

We incurred cost savings initiatives expenses of $290 million in 2013 and $303 million in 2012. Our costs savings

initiatives include a multi-year $650 million restructuring program consisting of restructuring costs, implementation

costs, and Spin-Off transition costs (the “Restructuring Program”), which was approved by our Board of Directors on

October 29, 2012. We have reduced our estimate of the total Restructuring Program costs to $625 million.

Approximately one-half of these costs will be cash expenditures. We spent cash of $150 million in 2013 and $111

million in 2012 related to our Restructuring Program. We expect to complete the Restructuring Program by the end

of 2014.

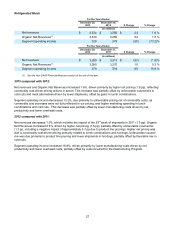

Debt

On May 18, 2012, we entered into a $3.0 billion five-year senior unsecured revolving credit facility in connection

with the Spin-Off. The agreement expires on May 17, 2017. On June 4, 2012, we issued $6.0 billion of senior

unsecured notes with a weighted average interest rate of 3.938% and transferred the net proceeds of $5.9 billion to

International. On July 18, 2012, International completed a debt exchange in which $3.6 billion

of International’s debt was exchanged for our debt as part of our Spin-Off-related capitalization plan.

There were no cash proceeds from the exchange. On October 1, 2012, International also transferred

approximately $0.4 billion of International’s 7.550% senior unsecured notes to us to complete the key

elements of the capitalization plan in connection with the Spin-Off.

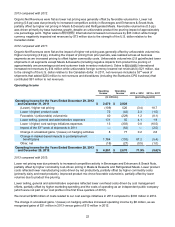

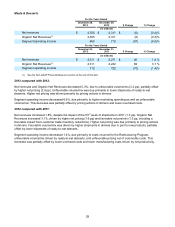

Postemployment Benefit Plans

We remeasure all of our postemployment benefit plans at least annually at the end of our fiscal year. The

remeasurement as of December 28, 2013 resulted in an aggregate benefit from market-based impacts of $1.6

billion, primarily driven by an 80 basis point weighted average increase in the discount rate for our pension and

postretirement plans and excess asset returns in our pension plans. The annual remeasurement resulted in

expense from market-based impacts of $223 million as of December 29, 2012 and $70 million as of December 31,

2011. We disclose market-based impacts separately in order to provide better transparency of our operating results.

We define market-based impacts as the costs or benefits resulting from the change in discount rates, the difference

between our estimated and actual return on trust assets, and other assumption changes driven by changes in the

law or other external factors.

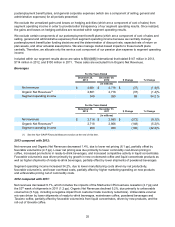

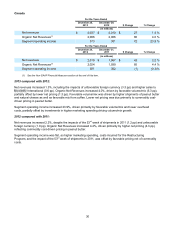

Starbucks CPG Business

On March 1, 2011, Starbucks took control of the Starbucks CPG business in grocery stores and other channels.

Starbucks did so without our authorization and in what we contended was a violation and breach of the Starbucks

Agreement. The dispute was arbitrated in Chicago, Illinois, and on November 12, 2013, the arbitrator issued a

decision awarding us compensation for Starbucks’ unilateral termination of the Starbucks Agreement. While we

remained the named party in the proceeding, pursuant to the Separation and Distribution Agreement between

International and us, International paid any costs and expenses incurred in connection with the

arbitration and we directed the payment of the recovery we were awarded in the arbitration proceeding to

International. The arbitration’s outcome did not have a material financial impact on us. The results of the Starbucks

CPG business were included our Beverages and Canada segments through March 1, 2011.

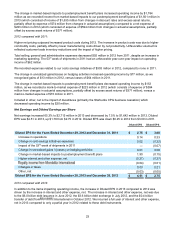

Provision for Income Taxes

Our effective tax rate was 33.6% in 2013, 33.1% in 2012, and 38.3% in 2011. Our 2013 effective tax rate was

unfavorably impacted by an increase in earnings due to the remeasurements of certain postemployment benefit

plans and favorably impacted by net discrete items totaling $61 million primarily from various U.S. federal, foreign,