Kraft 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

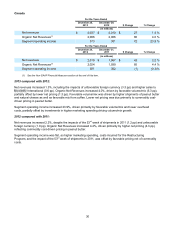

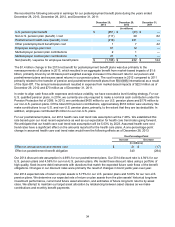

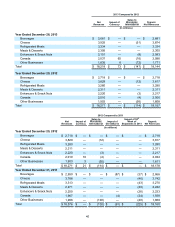

While we do not anticipate further changes in the 2014 assumptions for our U.S. and non-U.S. pension and

postretirement health care plans, as a sensitivity measure, a fifty-basis point change in our discount rate or a fifty-

basis point change in the actual rate of return on plan assets would have the following effects, increase / (decrease)

in cost, as of December 28, 2013:

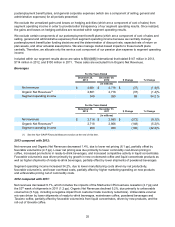

U.S. Plans Non-US. Plans

Fifty-Basis-Point Fifty-Basis-Point

Increase Decrease Increase Decrease

(in millions)

Effect of change in discount rate on pension costs $ (393) $ 439 $ (84) $ 91

Effect of change in actual rate of return on plan assets on pension costs (28) 28 (6) 6

Effect of change in discount rate on postretirement health care costs (166) 183 (10) 12

Prior to the Spin-Off, International provided defined benefit pension, postretirement health care, defined

contribution, and multiemployer pension and medical benefits to our eligible employees and retirees. Our

consolidated statements of earnings for the years ended December 29, 2012 and December 31, 2011 included

expense allocations for these benefits through September 30, 2012, which were determined based on a review of

personnel by business unit and based on allocations of corporate or other shared functional personnel. We consider

the expense allocation methodology and results to be reasonable for all periods presented.

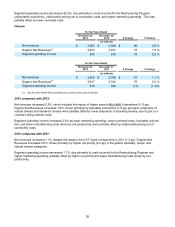

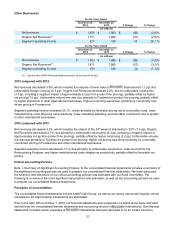

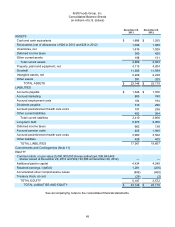

Total International benefit plan costs allocated to us in the first nine months of 2012 prior to the Spin-Off

and in the full year 2011 were as follows:

2012 2011

(in millions)

Pension plan cost $ 283 $ 261

Postretirement health care cost 142 160

Employee savings plan cost 49 54

Multiemployer pension plan cost 2 2

Multiemployer medical plan cost 15 20

Net expense for employee benefit plans $ 491 $ 497

These costs are reflected in our cost of sales and selling, general and administrative expenses. These costs were

funded through intercompany transactions with International and were reflected within the parent

company investment equity balance. The increase in benefit plan costs allocated to us from International

in 2012 compared to 2011, on an annualized basis, is due to an increase in the benefit plan costs recognized by

International in 2012 driven by a decrease in the discount rate used.

Income Taxes:

We recognize income taxes based on amounts refundable or payable for the current year and record deferred tax

assets or liabilities for any difference between U.S. GAAP accounting and tax reporting. We also recognize

deferred tax assets for temporary differences, operating loss carryforwards, and tax credit carryforwards. Inherent

in determining our annual tax rate are judgments regarding business plans, planning opportunities and expectations

about future outcomes. Realization of certain deferred tax assets, primarily net operating loss and other

carryforwards, is dependent upon generating sufficient taxable income in the appropriate jurisdiction prior to the

expiration of the carryforward periods. See Note 12, Income Taxes, for additional information.

We apply a more-likely-than-not threshold to the recognition and derecognition of uncertain tax positions.

Accordingly, we recognize the amount of tax benefit that has a greater than 50 percent likelihood of being ultimately

realized upon settlement. Future changes in judgment related to the expected ultimate resolution of uncertain tax

positions will affect earnings in the quarter of such change.

New Accounting Guidance

See Note 1, Summary of Significant Accounting Policies, for a discussion of new accounting guidance.