Kraft 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

authorization and in what we contended was a violation and breach of our license and supply agreement with

Starbucks related to the Starbucks CPG business (the “Starbucks Agreement”). The dispute was arbitrated in

Chicago, Illinois, and on November 12, 2013, the arbitrator issued a decision awarding us compensation for

Starbucks’ unilateral termination of the Starbucks Agreement. While we remained the named party in the

proceeding, pursuant to the Separation and Distribution Agreement between International and us,

International paid any costs and expenses incurred in connection with the arbitration and we directed the

payment of the recovery we were awarded in the arbitration proceeding to International. The arbitration’s

outcome did not have a material financial impact on us.

While we cannot predict with certainty the results of Legal Matters in which we are currently involved or may in the

future be involved, we do not expect that the ultimate costs to resolve any of the Legal Matters that are currently

pending will have a material adverse effect on our financial condition or results of operation.

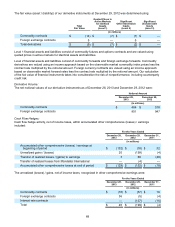

Third-Party Guarantees:

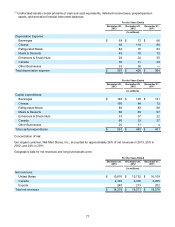

We have third-party guarantees primarily covering long-term obligations related to leased properties. The carrying

amount of our third-party guarantees on our consolidated balance sheet was $24 million at December 28, 2013 and

$22 million at December 29, 2012. The maximum potential payment under these guarantees was $53 million at

December 28, 2013 and $64 million at December 29, 2012. Substantially all of these guarantees expire at various

times through 2027.

Leases:

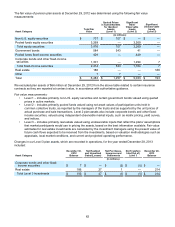

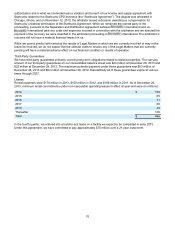

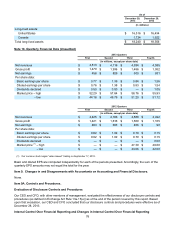

Rental expenses were $176 million in 2013, $150 million in 2012, and $169 million in 2011. As of December 28,

2013, minimum rental commitments under non-cancelable operating leases in effect at year-end were (in millions):

2014 $ 109

2015 85

2016 71

2017 56

2018 49

Thereafter 126

Total $ 496

In the fourth quarter, we entered into a build-to-suit lease on a facility we expect to be completed in early 2015.

Under this agreement, we have committed to pay approximately $70 million over a 21-year lease term.