Kraft 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

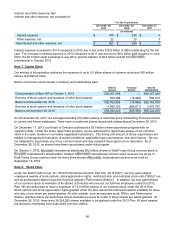

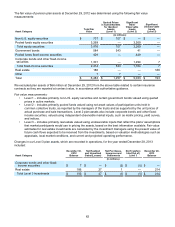

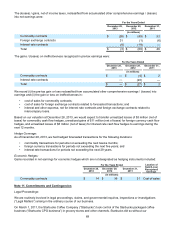

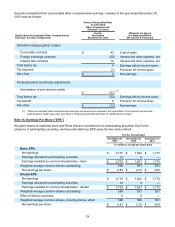

Assumed health care cost trend rates have a significant impact on the amounts reported for the health care plans. A

one-percentage-point change in assumed health care cost trend rates would have the following effects as of

December 28, 2013:

One-Percentage-Point

Increase Decrease

(in millions)

Effect on annual service and interest cost $ 21 $ (17)

Effect on postretirement benefit obligation 340 (284)

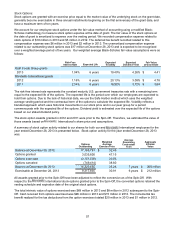

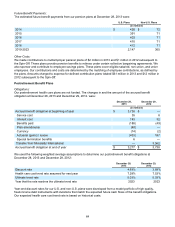

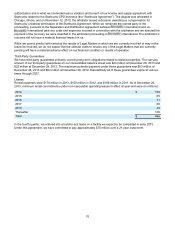

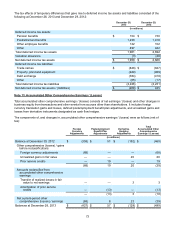

Components of Net Postretirement Health Care (Benefit) / Cost:

Net postretirement health care (benefit) / cost consisted of the following for the years ended December 28, 2013,

December 29, 2012, and December 31, 2011:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Service cost $ 35 $ 8 $ —

Interest cost 143 32 —

Actuarial (gains) / losses (376) 188 —

Amortization of prior service credit (26) (7) —

Special termination benefits 5 — —

Net postretirement health care (benefit) / cost $ (219) $ 221 $ —

As a result of the annual remeasurement of our postretirement health care plans, we recorded a benefit from

market-based impacts of $292 million as of December 28, 2013, primarily driven by an 80 basis point weighted

average increase in the discount rate. We recorded expense from market-based impacts of $250 million as of

December 29, 2012. Market-based impacts are included in actuarial (gains) / losses in the table above. The special

termination benefits were associated with our voluntary early retirement program in 2013.

As of December 28, 2013, we expected to amortize an estimated $29 million of prior service credit from

accumulated other comprehensive earnings / (losses) into net postretirement health care costs during 2014.

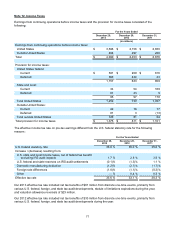

We used the following weighted average assumptions to determine our net postretirement cost for the years ended

December 28, 2013, December 29, 2012, and December 31, 2011:

December 28,

2013 December 29,

2012 December 31,

2011

Discount rate 3.89% 3.61% N/A

Health care cost trend rate 7.53% 7.06% N/A

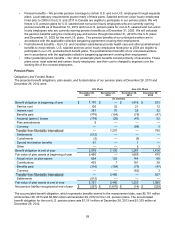

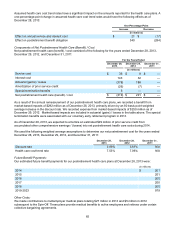

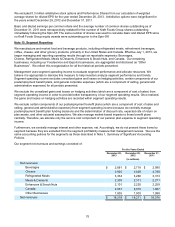

Future Benefit Payments:

Our estimated future benefit payments for our postretirement health care plans at December 28, 2013 were:

(in millions)

2014 $ 201

2015 201

2016 200

2017 200

2018 200

2019-2023 979

Other Costs:

We made contributions to multiemployer medical plans totaling $27 million in 2013 and $5 million in 2012

subsequent to the Spin-Off. These plans provide medical benefits to active employees and retirees under certain

collective bargaining agreements.