Kraft 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

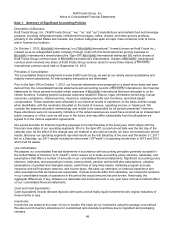

Prior Period Revisions:

Beginning in the third quarter of 2013, we record expense related to certain consumer incentive programs as a

reduction of net revenues. Previously, we included this expense in selling, general and administrative expenses.

We have revised prior periods to reflect this in our current presentation. The impacts of these revisions, which were

not material to any prior period, reduced net revenues and selling, general and administrative expenses by $68

million in 2012 and $79 million in 2011.

During 2013, we determined that we had overstated indefinite-lived tradenames in the purchase accounting of a

2001 acquisition. Therefore, we have revised our financial statements to reduce our Foodservice indefinite-lived

intangible assets by $403 million, reduce our deferred tax liability by $150 million, and increase goodwill by $253

million. This misstatement was not material to any of our prior period financial statements.

In 2012, we misclassified approximately $879 million of United States Foodservice long-lived assets as being

located in Canada. We have corrected and revised the balances reported in our long-lived assets by geographic

area table in Note 15, Segment Reporting, as of December 29, 2012 for this change. This misstatement was not

material to any of our prior period financial statements.

New Accounting Pronouncements:

In July 2013, the Financial Accounting Standards Board issued an accounting standard update which will require us

to present an unrecognized tax benefit as a reduction to a deferred tax asset for a net operating loss carryforward, a

similar tax loss, or a tax credit carryforward in our financial statements, with certain exceptions. The update will be

effective for fiscal years beginning after December 15, 2013. We do not expect the adoption of this guidance to

have a material impact on our financial statements.

Subsequent Events:

We evaluate subsequent events and reflect accounting and disclosure requirements related to material subsequent

events in our financial statements and related notes. We did not identify any material subsequent events impacting

our financial statements in this report.

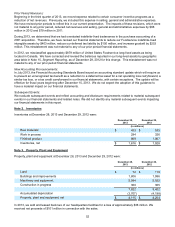

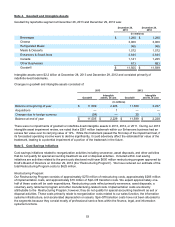

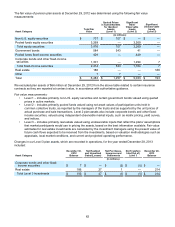

Note 2. Inventories

Inventories at December 28, 2013 and December 29, 2012 were:

December 28,

2013 December 29,

2012

(in millions)

Raw materials $ 453 $ 535

Work in process 294 326

Finished product 869 1,067

Inventories, net $ 1,616 $ 1,928

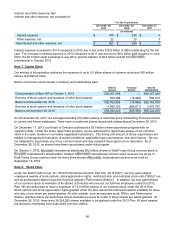

Note 3. Property, Plant and Equipment

Property, plant and equipment at December 28, 2013 and December 29, 2012 were:

December 28,

2013 December 29,

2012

(in millions)

Land $ 72 $ 119

Buildings and improvements 1,806 1,996

Machinery and equipment 5,584 5,922

Construction in progress 360 365

7,822 8,402

Accumulated depreciation (3,707) (4,198)

Property, plant and equipment, net $ 4,115 $ 4,204

In 2013, we sold and leased back two of our headquarters facilities for a loss of approximately $36 million. We

received net proceeds of $101 million in connection with the sales.