Kraft 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

2012 compared with 2011:

In addition to the items impacting operating income, the decrease in Diluted EPS in 2012 compared to 2011 was

driven by the increase in interest and other expense, net. The increase in interest and other expense, net was due

to the $6.0 billion debt issuance in June 2012, the $3.6 billion debt exchange in July 2012, and the $0.4 billion

transfer of debt from International in October 2012. As a result, we incurred a partial year of interest and

other expense, net in 2012 related to these debt instruments compared to none in 2011.

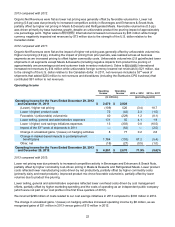

Results of Operations by Reportable Segment

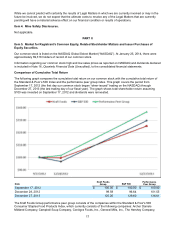

Effective July 1, 2013, we began managing and reporting operating results through six reportable segments:

Beverages, Cheese, Refrigerated Meals, Meals & Desserts, Enhancers & Snack Nuts, and Canada. Our remaining

businesses, including our Foodservice and Exports businesses, are aggregated and disclosed as “Other

Businesses”. We reflect this reorganization for all the historical periods presented.

The following discussion compares our results of operations for each of our reportable segments for 2013 with 2012

and 2012 with 2011.

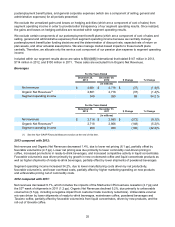

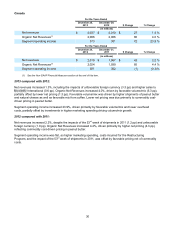

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Net revenues:

Beverages $ 2,681 $ 2,718 $ 2,990

Cheese 3,925 3,829 3,788

Refrigerated Meals 3,334 3,280 3,313

Meals & Desserts 2,305 2,311 2,271

Enhancers & Snack Nuts 2,101 2,220 2,259

Canada 2,037 2,010 1,967

Other Businesses 1,835 1,903 1,988

Net revenues $ 18,218 $ 18,271 $ 18,576

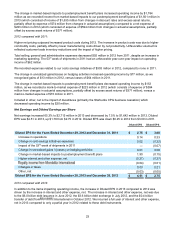

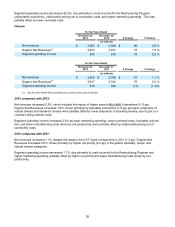

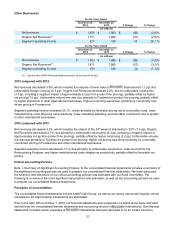

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Earnings before income taxes:

Operating income:

Beverages $ 349 $ 260 $ 450

Cheese 634 618 629

Refrigerated Meals 329 379 319

Meals & Desserts 665 712 722

Enhancers & Snack Nuts 529 592 594

Canada 373 301 302

Other Businesses 227 180 182

Unrealized gains / (losses) on hedging activities 21 13 (64)

Certain postemployment benefit plan income / (costs) 1,622 (305) (240)

General corporate expenses (158) (80) (66)

Operating income $ 4,591 $ 2,670 $ 2,828

Management uses segment operating income to evaluate segment performance and allocate resources. We

believe it is appropriate to disclose this measure to help investors analyze segment performance and trends.

Segment operating income excludes unrealized gains and losses on hedging activities, certain components of our