Kraft 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

Other Postemployment Benefit Plans

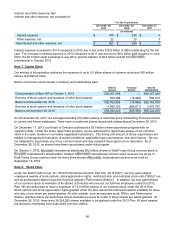

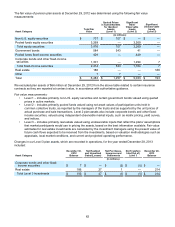

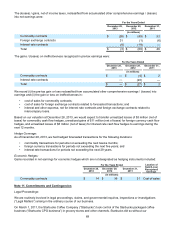

Obligations:

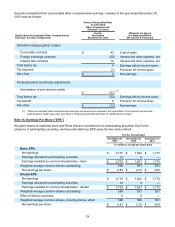

Our other postemployment plans are primarily not funded. The changes in and the amount of the accrued benefit

obligation at December 28, 2013 and December 29, 2012 were:

December 28,

2013 December 29,

2012

(in millions)

Accrued benefit obligation at beginning of year $ 63 $ 52

Service cost 2 4

Interest cost 2 2

Benefits paid (6) (10)

Actuarial gains (2) (1)

— 15

Other (4) 1

Accrued benefit obligation at end of year $ 55 $ 63

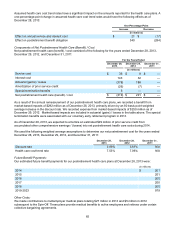

The accrued benefit obligation was determined using a weighted average discount rate of 3.1% in 2013 and 2.6%

in 2012, an assumed ultimate annual turnover rate of 0.5% in 2013 and 2012, a weighted average assumed

compensation cost increase of 4.0% in 2013 and 3.5% in 2012, and assumed benefits as defined in the respective

plans.

Other postemployment costs arising from actions that offer employees benefits in excess of those specified in the

respective plans are charged to expense when incurred.

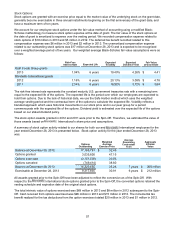

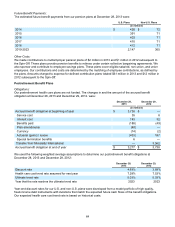

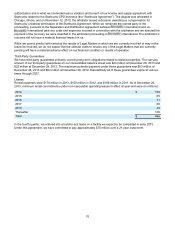

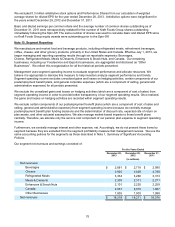

Components of Net Postemployment Cost:

Net postemployment cost consisted of the following for the years ended December 28, 2013, December 29, 2012,

and December 31, 2011:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Service cost $ 2 $ 4 $ 2

Interest cost 2 2 1

Actuarial (gains) / losses (2) 1 23

Other (1) — 16

Net other postemployment cost $ 1 $ 7 $ 42

A benefit from market-based impacts of $1 million as of December 28, 2013 and an expense of $2 million as of

December 29, 2012 and December 31, 2011 were included in actuarial (gains) / losses in the table above. Other

postemployment costs in 2011 primarily relate to the recognition of the partially funded Canadian postemployment

plan.

As of December 28, 2013, we do not expect to amortize any prior service cost / (credit) for the other

postemployment benefit plans from accumulated other comprehensive earnings / (losses) into net postemployment

costs during 2014.

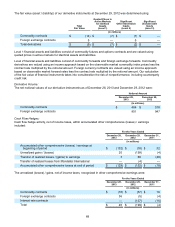

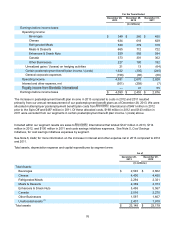

Our Participation in International’s Pension and Other Postemployment Benefit Plans and the

Spin-Off Impact

Prior to the Spin-off, International provided defined benefit pension, postretirement health care, defined

contribution, and multiemployer pension and medical benefits to our eligible employees and retirees. As such, we

applied the multiemployer plan accounting approach and these liabilities were not reflected in our consolidated

balance sheets. We provided pension coverage for certain employees of our Canadian operations through separate

plans and certain pension and postemployment benefits of our Canadian operations, which were included in our

financial statements prior to the Spin-Off. As part of the Spin-Off, the plans were split and we assumed the