Kraft 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

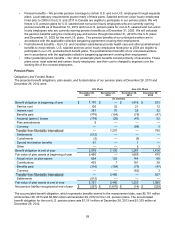

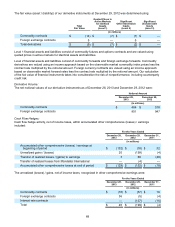

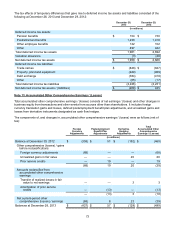

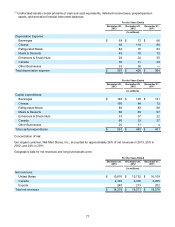

The (losses) / gains, net of income taxes, reclassified from accumulated other comprehensive earnings / (losses)

into net earnings were:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Commodity contracts $ (26) $ (49) $ 52

Foreign exchange contracts 31 (1) (6)

Interest rate contracts (8) (19) —

Total $ (3) $ (69) $ 46

The gains / (losses) on ineffectiveness recognized in pre-tax earnings were:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Commodity contracts $ — $ (4) $ 2

Interest rate contracts — (23) —

Total $ — $ (27) $ 2

We record (i) the pre-tax gain or loss reclassified from accumulated other comprehensive earnings / (losses) into

earnings and (ii) the gain or loss on ineffectiveness in:

• cost of sales for commodity contracts;

• cost of sales for foreign exchange contracts related to forecasted transactions; and

• interest and other expense, net for interest rate contracts and foreign exchange contracts related to

intercompany loans.

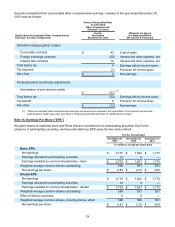

Based on our valuation at December 28, 2013, we would expect to transfer unrealized losses of $3 million (net of

taxes) for commodity cash flow hedges, unrealized gains of $11 million (net of taxes) for foreign currency cash flow

hedges, and unrealized losses of $8 million (net of taxes) for interest rate cash flow hedges to earnings during the

next 12 months.

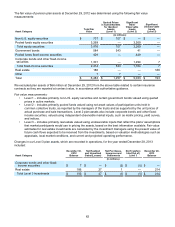

Hedge Coverage:

As of December 28, 2013, we had hedged forecasted transactions for the following durations:

• commodity transactions for periods not exceeding the next twelve months;

• foreign currency transactions for periods not exceeding the next five years; and

• interest rate transactions for periods not exceeding the next 29 years.

Economic Hedges:

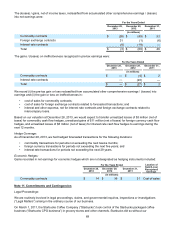

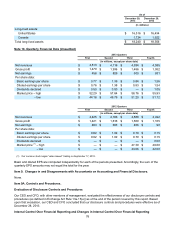

Gains recorded in net earnings for economic hedges which are not designated as hedging instruments included:

For the Years Ended Location of

Gain/(Loss)

Recognized

Earnings

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Commodity contracts $ 14 $ 36 $ 31 Cost of sales

Note 11. Commitments and Contingencies

Legal Proceedings:

We are routinely involved in legal proceedings, claims, and governmental inquiries, inspections or investigations

(“Legal Matters”) arising in the ordinary course of our business.

On March 1, 2011, the Starbucks Coffee Company (“Starbucks”) took control of the Starbucks packaged coffee

business (“Starbucks CPG business”) in grocery stores and other channels. Starbucks did so without our