Kraft 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Contingencies

See Note 11, Commitments and Contingencies, to the consolidated financial statements for a discussion of

contingencies.

Commodity Trends

We purchase large quantities of commodities, including dairy products, coffee beans, meat products, wheat, corn

products, soybean and vegetable oils, nuts, and sugar and other sweeteners. In addition, we use significant

quantities of resins and cardboard to package our products and natural gas to operate our facilities. We

continuously monitor worldwide supply and cost trends of these commodities.

During 2013, our aggregate commodity costs increased over the prior year period, primarily as a result of higher

costs of dairy, meat products, packaging materials and flour and grain costs, partially offset by lower coffee, nuts,

sugar and soy bean and vegetable oil costs. Our commodity costs increased approximately $119 million in 2013

and $248 million in 2012 compared to the prior year.

Despite higher commodity costs, our total product costs decreased in 2013 compared to the comparable prior year

period driven by net productivity.

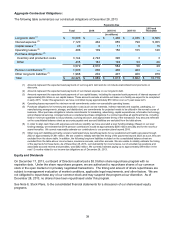

Liquidity and Capital Resources

We believe that cash generated from our operating activities, our $3.0 billion revolving credit facility, and our

commercial paper program will provide sufficient liquidity to meet our working capital needs, expected cost savings

initiatives expenditures, planned capital expenditures, planned contributions to our postemployment benefit plans,

future contractual obligations, and payment of our anticipated quarterly dividends. We will use our cash on hand

and our commercial paper program for daily funding requirements. Overall, we do not expect any negative effects

on our funding sources that would have a material effect on our short-term or long-term liquidity.

Net Cash Provided by Operating Activities:

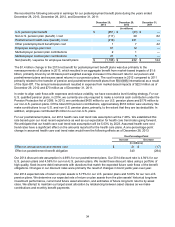

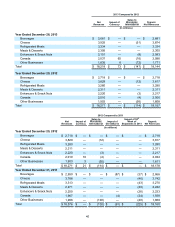

Operating activities provided net cash of $2.0 billion in 2013, $3.0 billion in 2012, and $2.7 billion in 2011. The

decrease in cash provided by operating cash flows in 2013 primarily related to a $569 million increase in pension

contributions, a $139 million increase in postretirement health care payments and higher cash paid for taxes and

interest. The increase in operating cash flows in 2012 was primarily related to earnings, partially offset by higher

interest payments on our long-term debt.

Net Cash Used in Investing Activities:

Net cash used in investing activities was $426 million in 2013, $422 million in 2012, and $401 million in 2011. An

increase in capital expenditures in 2013 was offset by an increase in proceeds from the sale of property, plant and

equipment. The increase in cash used in investing activities in 2012 primarily related to increased capital

expenditures partially offset by proceeds from the sale of property, plant and equipment.

Capital expenditures were $557 million in 2013, $440 million in 2012, and $401 million in 2011. The increase in

capital expenditures includes those required for our cost savings initiatives and additional investments in our

business to modernize manufacturing facilities and support new product and productivity initiatives. We expect 2014

capital expenditures to be approximately $560 million, including capital expenditures required for our cost savings

initiatives. We expect to fund these expenditures with cash from operations.

Net Cash Used in Financing Activities:

Net cash used in financing activities was $1.2 billion in 2013, $1.4 billion in 2012, and $2.3 billion in 2011. We paid

dividends of $1.2 billion in 2013. The net cash used in 2012 primarily related to $7.2 billion of net transfers to

International partially offset by the net proceeds we received from our $6.0 billion debt issuance. The net

cash used in financing activities in 2011 primarily related to net transfers to International.

Borrowing Arrangements:

On May 18, 2012, we entered into a $3.0 billion five-year senior unsecured revolving credit facility that expires on

May 17, 2017. All committed borrowings under the facility bear interest at a variable annual rate based on the

London Inter-Bank Offered Rate or a defined base rate, at our election, plus an applicable margin based on the